ITW Stock Recent News

ITW LATEST HEADLINES

14 Dividend Kings continue to outperform the S&P 500 in 2025. Dividend growth remains healthy, with one recent increase and a collective 2025 growth rate of 5.23%. Seventeen Dividend Kings currently appear undervalued with strong long-term return potential, using Dividend Yield Theory for valuation.

Illinois Tool Works (ITW) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

GLENVIEW, Ill., July 11, 2025 (GLOBE NEWSWIRE) -- Illinois Tool Works Inc. (NYSE: ITW) will issue its second quarter 2025 results on Wednesday, July 30, 2025, at 7:00 a.m. CDT. Following the release, ITW will hold its second quarter 2025 earnings webcast at 9:00 a.m. CDT.

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Illinois Tool Works (ITW) have what it takes?

Illinois Tool Works boasts strong ROIC, efficient capital allocation, and a shareholder-friendly approach, making it attractive for dividend investors seeking stability. Programmatic acquisitions and strategic divestitures have enhanced ITW's portfolio, but growth opportunities are less visible compared to peers like Dover. ITW's manageable debt and robust free cash flow support its dividend, though higher leverage poses a risk in a deep recession scenario.

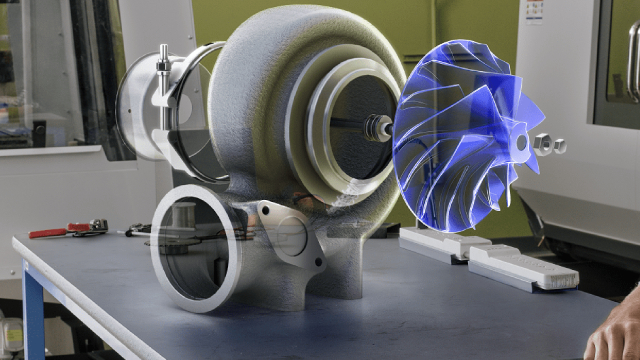

With significant growth opportunities in North America, Europe, and promising potential in Asia and Latin America, the market adapts to raw material price fluctuations and advanced joining technologies threats With significant growth opportunities in North America, Europe, and promising potential in Asia and Latin America, the market adapts to raw material price fluctuations and advanced joining technologies threats

ITW sees steady growth in key segments and margins, but debt concerns and weakness in the MTS Test & Simulation unit cloud the outlook.

Illinois Tool Works (ITW 0.64%) -- often referred to simply as ITW -- is an industrial conglomerate and Dividend King that has boosted its payout for 61 consecutive years. However, ITW's stock price and earnings have stagnated as the company faces a challenging operating environment.

Live Updates Live Coverage Has Ended SPY Turns Positive 3:50 pm by Gerelyn Terzo The SPY ETF has reversed earlier declines and is now headed for a gain of 0.45% on the day. Meanwhile, JPMorgan has expanded its list of top stocks, coinciding with the final month of trading for H1 2025. The analyst firm has reportedly turned more bullish on Take-Two Interactive (Nasdaq: TTWO) and Netflix (Nasdaq: NFLX), joining a cohort that also includes McDonald’s (NYSE: MCD) and Boeing (NYSE: BA). Market Movers 1:01 pm by Gerelyn Terzo Steel Dynamics (Nasdaq: STLD) is out front with a 9.5% gain. Fellow steelmaker Nucor (NYSE: NUE) is rising close to 9% on the steel tariff development. Newmont (NYSE: NEM) is tacking on 6% as the gold price soars and investors run for shelter. GM (NYSE: GM) and Ford (NYSE: F) are lower by 4% and 3%, respectively, as steel import tariffs come into focus. The SPY ETF is currently higher by 0.11%. Factory Sector Slowdown 11:07 am by Gerelyn Terzo U.S. manufacturing a

Illinois Tool Works (ITW) reported earnings 30 days ago. What's next for the stock?