JNJ Stock Recent News

JNJ LATEST HEADLINES

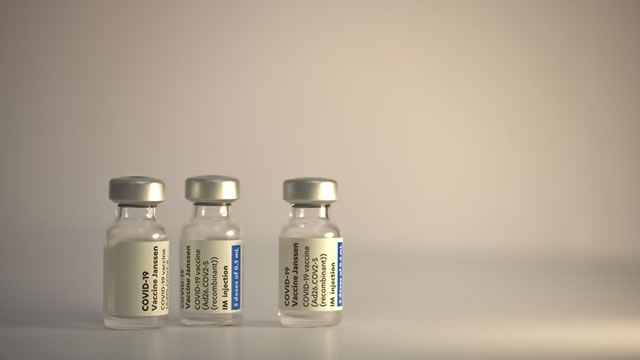

Johnson & Johnson (JNJ 1.57%) is one of the world's largest healthcare companies by market capitalization. The drugmaker has diversified operations, generating consistent revenue and profits.

These top medical stocks may be able to provide defensive safety after President Trump's tariff hikes and July's unfavorable jobs report led to a market selloff.

Founded in 1869, Goldman Sachs is the world's second-largest investment bank by revenue and is ranked 55th on the Fortune 500 list of the largest U.S.

Measures laid out in letters to 17 companies would either have modest impact or face legal challenges, say industry experts.

JNJ edges out AZN following Q2 results with raised guidance, stronger estimate revisions and a more attractive valuation.

Former FDA Commissioner Dr. Scott Gottlieb joins 'Squawk Box' to discuss news of President Trump ordering pharma companies to lower U.S. drug prices in the next 60 days, the move to tiered pricing globally, the future of gene therapy, changes at FDA, and more.

Boost your portfolio with ADBE, DIS, INTU, ROL and JNJ as these five wide moat stocks poised for growth and strong returns.

CNBC's Joe Kernen reports on the latest news.

U.S. President Donald Trump sent letters to the chief executives of 17 major pharmaceutical companies, urging immediate action to lower the cost of prescription drugs for Americans, the White House said on Thursday.

President Donald Trump said he asked major pharmaceutical companies to take steps to cut U.S. drug prices within the next 60 days. It comes after Trump in May signed an executive order reviving a controversial policy that aims to slash drug costs by tying the prices of some medicine in the U.S. to the significantly lower ones abroad.