KHC Stock Recent News

KHC LATEST HEADLINES

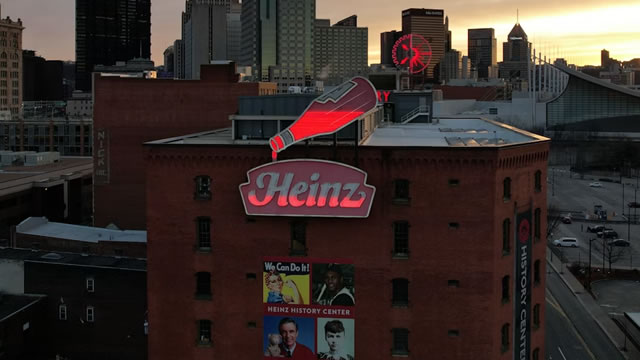

KHC battles weak volumes, shifting consumer habits and cost pressures that threaten sales and margins.

Kraft Heinz (KHC) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Kraft Heinz (NASDAQ: KHC) is reportedly preparing to split into two or possibly three businesses, separating high-margin consumer staples like condiments and mac & cheese from lower-margin grocery and meat segments.

Kraft Heinz (KHC) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Kraft Heinz's potential spinoff of slower-growing brands such as Velveeta cheese is a risky last-ditch effort to boost returns by reversing its unsuccessful decade-old merger.

The Nasdaq-100 index is home to some of the most exciting growth stocks on the market. It includes nine of the 10 largest stocks by market cap.

Deal OverviewAccording to media publications on July 11, 2025, The Kraft Heinz Company (NASDAQ: KHC, $27.58, Market Capitalization: $32.64 billion), a leading global packaged food company, is contemplating spinning-off its grocery business while retaining its high growth condiments and sauces segment. As per market estimates, the spin-off entity would command a valuation $20 billion, on favorable turnaround of business prospects.

Kraft Heinz (KHC) closed at $27.58 in the latest trading session, marking a +1.7% move from the prior day.

Warren Buffett -- one of the most highly esteemed investors of all time, if not the most -- has been a consistent source of investing insights for decades. In addition to his numerous pearls of wisdom, the stock purchases Buffett makes through his conglomerate, Berkshire Hathaway, are also closely followed.

TD Cowen analysts say food-industry megamergers haven't worked.