KMB Stock Recent News

KMB LATEST HEADLINES

Kimberly-Clark Corporation (NASDAQ:KMB ) Piper Sandler's Growth Frontiers Conference September 10, 2025 10:30 AM EDT Company Participants Michael Hsu - Chairman & CEO Nelson Urdaneta - Senior VP & CFO Conference Call Participants Michael Lavery - Piper Sandler & Co., Research Division Presentation Michael Lavery Managing Director & Senior Research Analyst All right. Well, thanks, everyone, for coming.

Weak job numbers and a likely Fed rate cut point to contradictory outcomes for the market, which suggests market volatility is in store for the foreseeable future. Kimberly-Clark's recent share price dip and near-4% dividend yield present a timely buying opportunity for defensive portfolio stability. Despite temporary financial weakness, Kimberly-Clark maintains healthy profit margins and manageable debt, supporting its sustainable dividend.

Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

Dividend stocks are the cornerstone of a great investment portfolio. The right mix of dividend stocks can provide security for your funds as well as a growing passive income stream, which is why they are even more important for retirees.

Kimberly-Clark Corporation (NASDAQ:KMB ) Barclays 18th Annual Global Consumer Staples Conference 2025 September 3, 2025 8:15 AM EDT Company Participants Russell Torres - President & COO Michael Hsu - Chairman & CEO Nelson Urdaneta - Senior VP & CFO Conference Call Participants Lauren Lieberman - Barclays Bank PLC, Research Division Presentation Lauren Lieberman MD & Senior Research Analyst Okay. We're going to get started.

DALLAS , Sept. 2, 2025 /PRNewswire/ -- Mike Hsu, Chairman and Chief Executive Officer of Kimberly-Clark Corporation (NASDAQ: KMB), and Nelson Urdaneta, Chief Financial Officer, will be featured speakers at the Piper Sandler Growth Frontiers Conference on Wednesday, September 10, at 9:30 a.m.

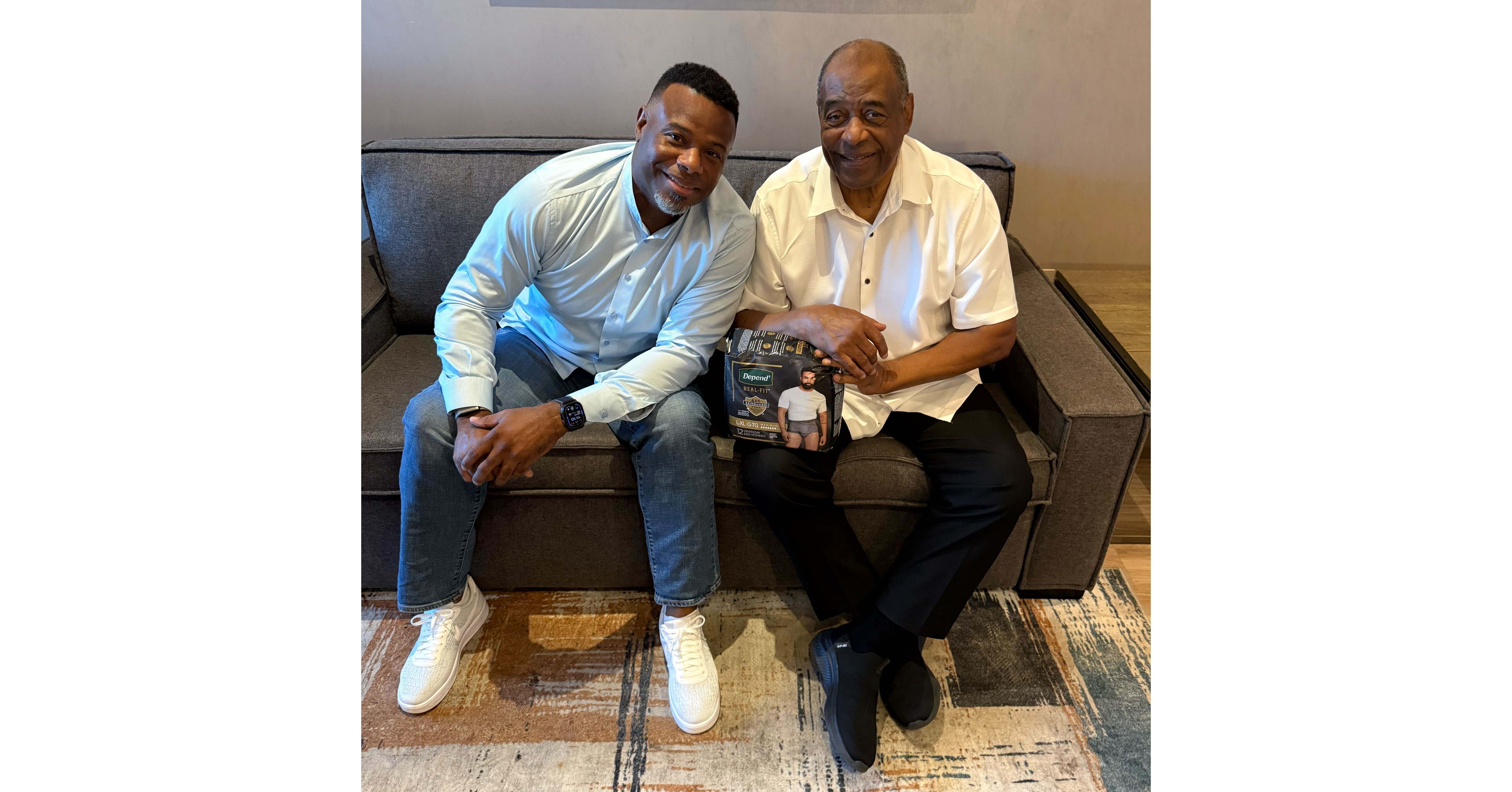

Ken Griffey Jr. and Ken Griffey Sr. Join Emmitt Smith for the Sixth Year of Depend®'s Stand Strong for Men's Health Campaign, Supporting the Prostate Cancer Foundation CHICAGO , Sept. 2, 2025 /PRNewswire/ -- Prostate cancer affects one in eight men1 and can lead to bladder leaks, yet remains a topic many still find hard to discuss.

DALLAS , Aug. 28, 2025 /PRNewswire/ -- Kimberly-Clark Corporation (NASDAQ: KMB) today announced the appointment of Stacey Valy Panayiotou to Chief Human Resources Officer, effective September 10th. Panayiotou will succeed interim Chief Human Resources Officer Viviane Cury, who will resume her prior role as Vice President, Talent Business Partner for North America.

Quality high-yield Dividend Kings stocks are perfect for generating passive income. The Federal Reserve will likely lower interest rates in September, and dividend stocks could get a boost.

According to a filing with the U.S. Securities and Exchange Commission (SEC) dated August 19, 2025, Slocum, Gordon & Co LLP reported selling all 20,789 shares of Kimberly-Clark Corporation (KMB -0.33%) during the second quarter.