KMT Stock Recent News

KMT LATEST HEADLINES

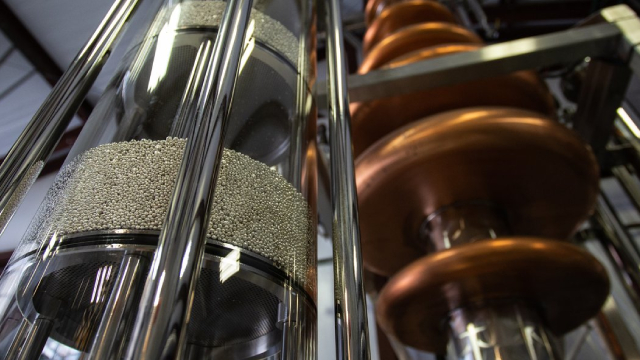

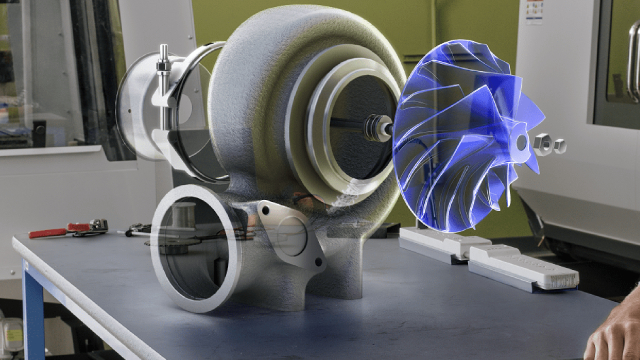

PITTSBURGH , Aug. 20, 2025 /PRNewswire/ -- Kennametal Inc. (NYSE: KMT) announced today that they will attend the Morgan Stanley 13th Annual Laguna Conference. Details of the conference are as follows: When: Wednesday, September 10, 2025 Attendees: Sanjay Chowbey, President and Chief Executive OfficerPatrick Watson, Vice President and Chief Financial OfficerMichael Pici, Vice President, Investor Relations About Kennametal With over 85 years as an industrial technology leader, Kennametal Inc. delivers productivity to customers through materials science, tooling and wear-resistant solutions.

Kennametal has faced revenue, profit, and cash flow declines due to end-market weakness, underperforming the S&P 500 since my last bullish rating. Despite near-term pain and recession risks, management's aggressive cost-cutting—including plant closures—should yield significant savings and improve future profitability. Relative to peers, KMT shares are extremely cheap on multiple valuation metrics, even when factoring in further expected earnings weakness.

PITTSBURGH , Aug. 13, 2025 /PRNewswire/ -- Kennametal Inc. (NYSE: KMT) announced today that they will attend the Jefferies Industrials Conference in New York City. Details of the conference are as follows: When: Wednesday, September 3, 2025 Attendees: Patrick Watson, Vice President and Chief Financial Officer Michael Pici, Vice President, Investor Relations About Kennametal With over 85 years as an industrial technology leader, Kennametal Inc. delivers productivity to customers through materials science, tooling and wear-resistant solutions.

KMT faces segment weakness, high debt and forex headwinds, causing earnings estimate cuts and stock underperformance.

KMT posts Q4 earnings and sales misses as lower volumes, inflation and raw material costs pressure margins.

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Kennametal (KMT) is technically in oversold territory now, so the heavy selling pressure might have exhausted. This along with strong agreement among Wall Street analysts in raising earnings estimates could lead to a trend reversal for the stock.

Kennametal Inc. (NYSE:KMT ) Q4 2025 Earnings Conference Call August 6, 2025 9:30 AM ET Company Participants Michael Pici - Vice President of Investor Relations Patrick S. Watson - VP of Finance & CFO Sanjay K.

The headline numbers for Kennametal (KMT) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Kennametal (KMT) could be a great choice for investors looking to buy stocks that have gained strong momentum recently but are still trading at reasonable prices. It is one of the several stocks that made it through our 'Fast-Paced Momentum at a Bargain' screen.