KMTUY Stock Recent News

KMTUY LATEST HEADLINES

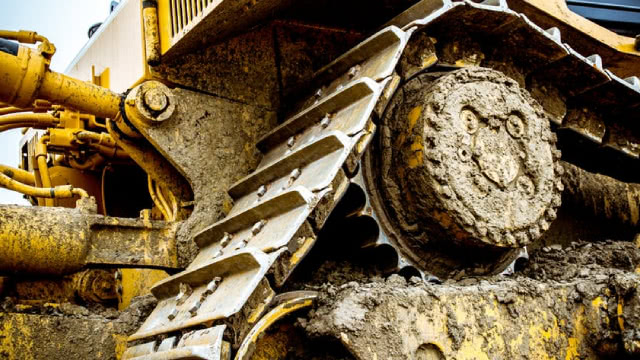

SAN FRANCISCO--(BUSINESS WIRE)--Komatsu, a global leader in mining and construction equipment, and Pronto, the Silicon Valley-based off-road autonomy pioneer, today announced a strategic collaboration to deploy Pronto's autonomous haulage technologies to quarry operations in the North American market. The partnership centers on the launch of Komatsu Smart Quarry Autonomous, powered by Pronto, a system that integrates Pronto's autonomy technologies into quarry-sized haul trucks and ties into Kom.

ELKO, Nev., Aug. 04, 2025 (GLOBE NEWSWIRE) -- Nevada Gold Mines (NGM) and Komatsu have officially launched a pioneering partnership to elevate workplace safety and enhance operational efficiency through the deployment of Komatsu's FrontRunner Autonomous Haulage System (AHS). NGM, operated by Barrick Mining Corporation, will be automating their fleet of 300 and 230 tonne haul trucks across their surface operations. While visiting the company's Cortez operations this week, Barrick president and chief executive Mark Bristow joined site leaders to witness a milestone moment—a live demonstration of the FrontRunner AHS. The collaboration marks the first implementation of the system for both companies within the United States, setting a new standard for mining operations nationwide.

Komatsu Ltd. (OTCPK:KMTUY) Q1 2025 Earnings Conference Call July 29, 2025 2:00 AM ET Call Participants Kiyoshi Hishinuma - Executive Officer & GM of Business Coordination Department Takeshi Horikoshi - CFO, Senior Executive Officer of Senmu & Representative Director Analysts Takeru Adachi - Goldman Sachs Group, Inc., Research Division Kentaro Maekawa - Nomura Securities Co. Ltd.

The prospects of the Zacks Manufacturing - Construction and Mining industry look good. Stocks like CAT, KMTUY, TEX and HY are stocks worth a look.

Inflation isn't just back, it's becoming policy. From skewed CPI data to deficit-driven dollar moves, we're entering a new and lasting macro era. The U.S. may now prefer higher inflation to fix its balance sheet and boost growth. That changes everything, including how we invest, where we invest, and why. I'm not overhauling my strategy. But I'm sharpening my focus on pricing power, hard assets, and income that's built for this new reality.

My bullish view of Komatsu stays unchanged, considering the presence of short-term and mid-term re-rating catalysts. A better-than-expected Q1'FY25 operating income could serve as a multiple expansion trigger for the Company in the near future. Komatsu has the potential to trade at higher P/Es and P/FCFs similar to its peers, taking into account its efforts to drive free cash flow growth in the next three years.

Komatsu should see a nearly 20 billion yen ($140 million) mitigation in the impact of U.S. tariffs on its bottom line after the U.S.-China trade truce last week, the Japanese company's CEO said, suggesting its outlook for lower profits may not be as bad as feared.

Caterpillar and Komatsu, two heavy equipment powerhouses, face challenges from tariff pressures. Find out which stock offers better value for investors.

Here is how Komatsu Ltd. (KMTUY) and Kone Oyj Unsponsored ADR (KNYJY) have performed compared to their sector so far this year.

The prospects of the Zacks Manufacturing - Construction and Mining industry look good. Stocks like CAT, KMTUY and HTCMY are stocks worth a look.