LEA Stock Recent News

LEA LATEST HEADLINES

Lear (LEA) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Investors with an interest in Automotive - Original Equipment stocks have likely encountered both Lear (LEA) and Hesai Group Sponsored ADR (HSAI). But which of these two stocks presents investors with the better value opportunity right now?

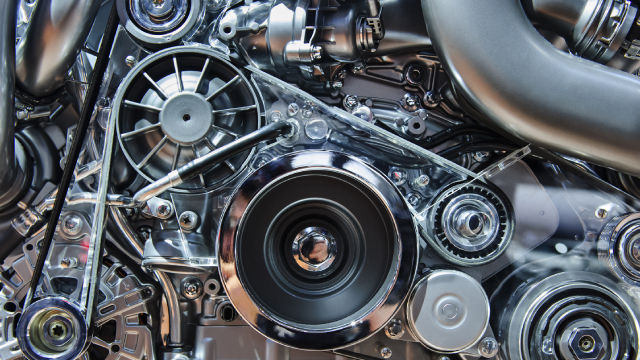

Lear Corporation, a key player in the automotive seating market, is undervalued and has strong fundamentals, making it an attractive long-term investment. Despite industry challenges, Lear's innovation, market position, and high switching costs for customers create a significant economic moat. LEA shows solid growth in premium vehicle segments and automotive electronics, with a conservative upside of at least 15% annualized returns.

SOUTHFIELD, Mich., Jan. 10, 2025 /PRNewswire/ -- Lear Corporation will hold a conference call to review the company's fourth quarter and full year 2024 financial results and related matters on February 6, 2025, at 9:00 a.m.

Lear (LEA) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

SOUTHFIELD, Mich. , Oct. 2, 2024 /PRNewswire/ -- Lear Corporation will hold a conference call to review the company's third quarter 2024 financial results and related matters on October 24, 2024, at 8:00 a.m.

SOUTHFIELD, Mich. , Aug. 29, 2024 /PRNewswire/ -- Lear Corporation (NYSE: LEA), a global automotive technology leader in Seating and E-Systems, will participate in a fireside chat on September 11, 2024, at the Morgan Stanley 12th Annual Laguna Conference in Dana Point, California.

SOUTHFIELD, Mich. , Aug. 15, 2024 /PRNewswire/ -- Lear Corporation (NYSE: LEA), a global automotive technology leader in Seating and E-Systems, today announced that its Board of Directors has declared a quarterly cash dividend of $0.77 per share on the Company's common stock.

SOUTHFIELD, Mich. , Aug. 12, 2024 /PRNewswire/ -- Lear Corporation (NYSE: LEA), a global automotive technology leader in Seating and E-Systems, today announced that Rod Lache, a distinguished former Wall Street automotive analyst, has been appointed to the Company's Board of Directors, effective August 12, 2024.

Examine Lear's (LEA) international revenue patterns and their implications on Wall Street's forecasts and the prospective trajectory of the stock.