LECO Stock Recent News

LECO LATEST HEADLINES

Here is how Lincoln Electric Holdings (LECO) and Life360 (LIF) have performed compared to their sector so far this year.

Lincoln Electric Holdings (LECO) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions.

Lincoln Electric (LECO) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

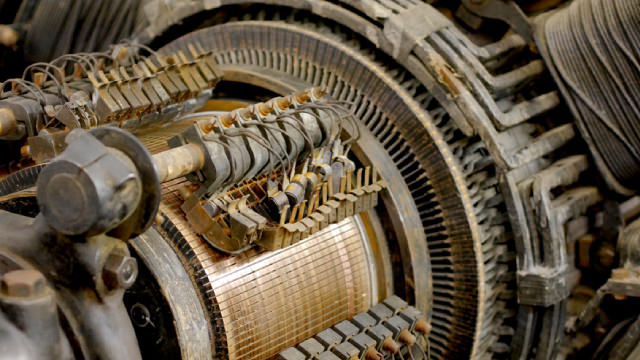

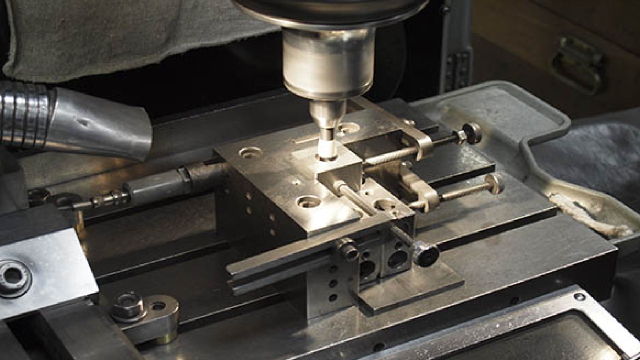

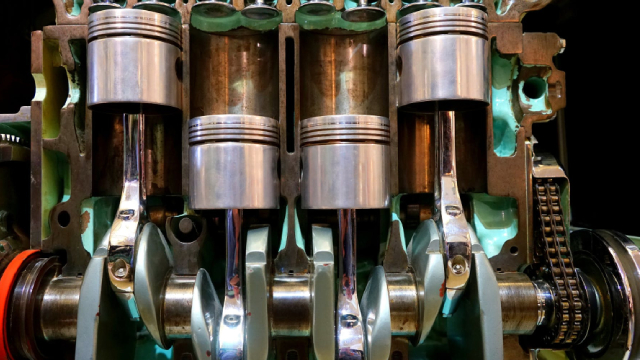

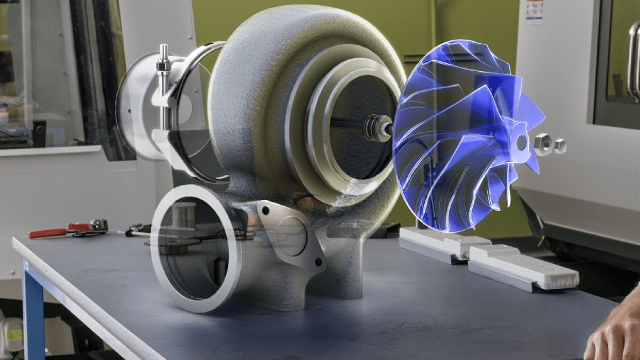

LECO is a high-quality, global leader in welding, with a sticky "razor-and-blades" business model driving recurring revenue. Capital allocation is disciplined, focusing on shareholder yield and small, bolt-on acquisitions rather than risky, transformative deals. LECO is a compounder worth watching for GARP investors, but patience is needed for a better entry point after recent tariff-driven volatility.

Does Lincoln Electric Holdings (LECO) have what it takes to be a top stock pick for momentum investors? Let's find out.

Investors need to pay close attention to Lincoln Electric stock based on the movements in the options market lately.

CLEVELAND--(BUSINESS WIRE)-- #LEA--Lincoln Electric Holdings, Inc. (Nasdaq: LECO) (the “Company”) announced today that it has acquired the remaining 65% interest in Alloy Steel Australia (Int) Pty Ltd. and its related businesses (“Alloy Steel”). The Company acquired an approximate 35% ownership interest in Alloy Steel on April 1, 2025, and following the completion of this transaction, the Company fully owns Alloy Steel. Alloy Steel is a privately held manufacturer of maintenance and repair solutions h.

Lincoln Electric remains a cash-generative industrial leader with a niche in welding consumables, equipment, and automation. LECO remains a top-quartile business, posting ~$0.10-$0.14 in FCF underneath every $1 of revenue. Valuations discounting above-hurdle earnings support a long-term holding margin on this name with dividend growth as a second value add.

Lincoln Electric Holdings, Inc. (NASDAQ:LECO ) Q2 2025 Earnings Conference Call July 31, 2025 10:00 AM ET Company Participants Amanda H. Butler - Vice President of Investor Relations & Communications Gabriel Bruno - Executive VP, CFO & Treasurer Steven B.

The headline numbers for Lincoln Electric (LECO) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.