LOW Stock Recent News

LOW LATEST HEADLINES

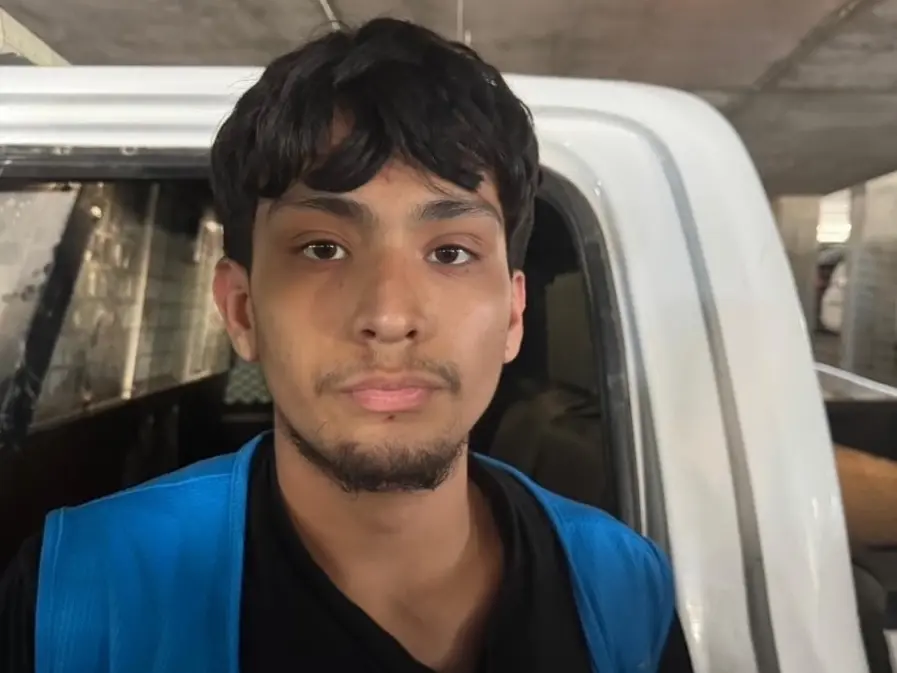

PICO RIVERA, CA — A U.S. citizen was arrested during a federal immigration raid in Pico Rivera Tuesday after he spoke out against an agent's questioning of another man. The violent takedown, which was caught on video, prompted a protest later that evening. Now, Rep. Linda Sánchez is demanding answers from federal officials about the incident and several other raids in the area that appear to target workers based on their ethnicity, she said in a letter to the Secretary of the Department of Homeland Security, the Director of U.S. Immigration and Customs Enforcement, and the U.S. Attorney General. Federal authorities conducted raids at multiple sites in the Southeast Los Angeles County city, including a Food 4 Less on Whittier Boulevard and a Lowes Home Improvement store on Washington Boulevard, where the confrontation occurred. Footage from the incident obtained by KTLA shows several masked border patrol agents in a struggle with a 20-year-old Adrian Andrew Martinez. Amid the scuffle

A focus on digitization, e-commerce, product innovation and new marketing techniques is encouraging for industry players like HD, LOW, WSM, LOVE.

Lowe's Companies, Inc. (NYSE:LOW ) Oppenheimer 25th Annual Consumer Growth and E-Commerce Conference June 11, 2025 1:30 PM ET Company Participants Brandon J. Sink - Executive VP & CFO Kate Pearlman - Vice President, Investor Relations & Treasurer Marvin R.

MOORESVILLE, NC — Popular hardware and home improvement store chain Lowe's has opened a number of new stores in 2025 and plans to open more before the end of the year, according to a new report. Additionally, the chain also plans to open more stores in 2026, making it even easier for shoppers across the U.S. to purchase tools, appliances, building materials and more all under one roof. New Store Locations USA Today reports Lowe's plans to open five to 10 new stores this year, two of which have already opened in Magnolia and Fort Worth, Texas. Additionally, a store in Asheville, N.C., that was closed due to Hurricane Helene in September has since reopened. A Lowe's spokesperson also confirmed to USA Today the company plans to open new stores in Georgetown, Texas, and Maricopa, Ariz., later this year. According to a store directory on the company's website, Lowe's operates over 100 stores in Texas and more than 30 in Arizona. Lowe's also operates over 100 stores in North Carolina where

Lowe's (LOW) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Dividend growth stocks, combined with regular investments, reduce the capital needed and time to reach $60,000 annually, leveraging compounding over time.

MOORESVILLE, N.C. , June 4, 2025 /PRNewswire/ -- Lowe's Companies, Inc. (NYSE: LOW) announces that Marvin R.

Over the last decade, shopping has changed. This change has occurred worldwide, most notably in technologically advanced countries like America. We once ventured out to “run errands”, a frequent activity that often included a stop at the mall or a trip to the local boutique. But with Amazon reigning supreme and tons of huge brands like Walmart and Target focusing on online sales, the nature of shopping in America has been drastically altered. With online retail comes the opportunity to reach any segment of the population from anywhere in the world. As competition skyrockets, brand recognition, marketing, and advertising become crucial to a company’s success. To find the 10 retail stores Americans love most, 24/7 Wall St. reviewed data from the recent 2025 Axios Harris Poll 100 Reputation Rankings. This consumer survey ranked 100 brands, giving each a score. These were accessed across several categories, such as Character, Trust, Growth, Vision, and Ethics. Depending o

Dividend growth investing prioritizes stocks with consistent payout increases, offering rising income and inflation protection for long-term stability.

LOW enters the $50 billion interior finishes market with a $1.325 billion ADG buy, expanding its Pro reach beyond retail operations.