MDT Stock Recent News

MDT LATEST HEADLINES

Medtronic stock fell early Wednesday despite beating forecasts after the company said it plans to spin off its diabetes business.

Despite challenges, Medtronic demonstrates the resilience of its underlying business fundamentals, delivering consistent mid-single-digit organic revenue growth.

GALWAY, Ireland , April 24, 2025 /PRNewswire/ -- Medtronic plc (NYSE: MDT), a global leader in healthcare technology, today announced it has submitted 510(k) applications to the U.S. Food and Drug Administration (FDA) seeking clearance for an interoperable pump. FDA clearance of this pump would pave the way for system integration with a continuous glucose monitoring (CGM) sensor based on Abbott's most advanced CGM platform.

Latest approval expands Medtronic CGM portfolio in the U.S. GALWAY, Ireland , April 18, 2025 /PRNewswire/ -- Medtronic plc (NYSE: MDT), a global leader in healthcare technology, today announced the U.S. Food and Drug Administration (FDA) approval for the Simplera Sync™ sensor for use with the MiniMed™ 780G system. With this approval, the MiniMed™ 780G system now offers more flexibility for users of the company's most advanced insulin delivery system featuring Meal Detection™ technology with both the Guardian™ 4 sensor and Simplera Sync™ sensor.

CALGARY, Alberta, April 10, 2025 (GLOBE NEWSWIRE) -- News Release – TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company) will release its first quarter 2025 financial results on Thursday, May 1 at 6:30 a.m. MDT / 8:30 a.m. EDT and hold its 2025 annual meeting of common shareholders on Thursday, May 8, at 10 a.m. MDT / 12 p.m. EDT.

GALWAY, Ireland and CHICAGO , March 30, 2025 /PRNewswire/ -- Medtronic plc (NYSE: MDT), a global leader in healthcare technology, today announced late-breaking data on five-year outcomes from the Evolut Low Risk Trial. Data shows, versus surgery, the Evolut™ transcatheter aortic valve replacement (TAVR) system delivers a numerically lower rate of all-cause mortality or disabling stroke at five years, strong valve performance and durable clinical outcomes.

NEW YORK, March 10, 2025 (GLOBE NEWSWIRE) -- CGS Immersive™, the leader in enterprise learning that is modernizing training and development with AI and XR technologies, today introduced Cicero™, a hyper realistic roleplay application for upskilling workforces. Using AI-powered interactions, Cicero facilitates immersive roleplay using lifelike personas and real-time feedback in scenarios so realistic, it helps trainees to master the unexpected things that happen in real-life interactions with customers and other business contacts.

CRT 2025 Late Breaking Science features largest head-to-head randomized control TAVR trial to primarily enroll women using the two most widely used global TAVR devices GALWAY, Ireland and WASHINGTON , March 9, 2025 /PRNewswire/ -- Medtronic plc (NYSE: MDT), a global leader in healthcare technology, today released the two-year results of the SMall A nnuli R andomized T o Evolut or SAPIEN (SMART) Trial, the largest international head-to-head comparative trial of transfemoral transcatheter aortic valve replacement (TAVR). In patients with aortic stenosis and a small aortic annulus, results showed comparable composite outcome of mortality, disabling stroke, and heart failure hospitalization, and continued superior valve performance as measured by bioprosthetic valve dysfunction (BVD) at two years for Evolut™ TAVR compared to SAPIEN™.

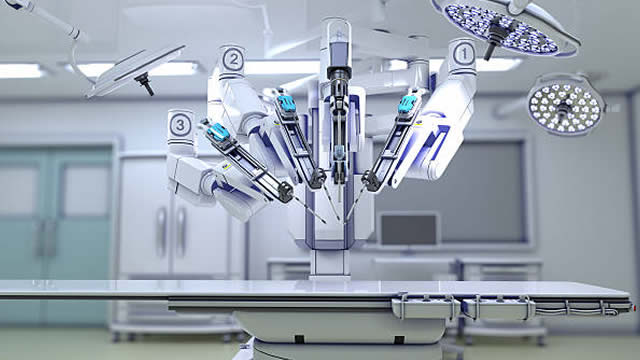

New closed-loop system self-adjusts DBS therapy to individual brain activity in real time; the largest commercial launch of brain-computer interface technology ever GALWAY, Ireland , Feb. 24, 2025 /PRNewswire/ -- For the one million people diagnosed with Parkinson's disease in the United States 1, Medtronic plc (NYSE:MDT), a global leader in healthcare technology, proudly announces U.S. Food and Drug Administration (FDA) approval of BrainSense™ Adaptive deep brain stimulation (aDBS) and BrainSense™ Electrode Identifier (EI). There is no cure for debilitating neurological conditions like Parkinson's, however, deep brain stimulation (DBS) has been transforming the lives of people with Parkinson's and other neurological disorders for more than 30 years.

Medtronic's NYSE: MDT growth efforts and investments in medical technology innovation are starting to pay off. The company's pulsed field ablation (PFA) technology is a key growth driver, strengthening both its cardiac segment and overall business expansion.