MIDD Stock Recent News

MIDD LATEST HEADLINES

The Middleby Corporation's near-term outlook remains challenging, with weak QSR demand and tariff headwinds expected to persist over the next two quarters. Long-term catalysts exist, including a potential FP segment spin-off and a delayed equipment replacement cycle that could drive multi-year growth. Despite some green shoots, core Commercial Foodservice organic sales continue to decline, and cost pressures from tariffs will worsen before improving.

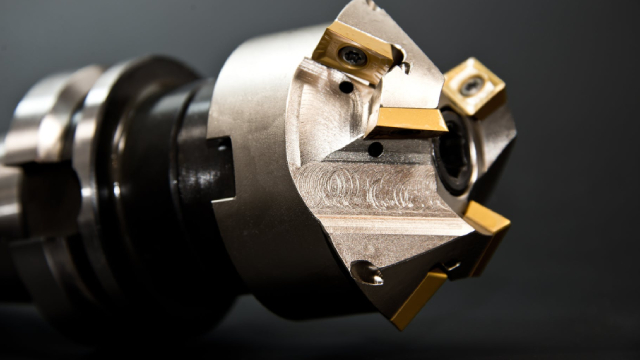

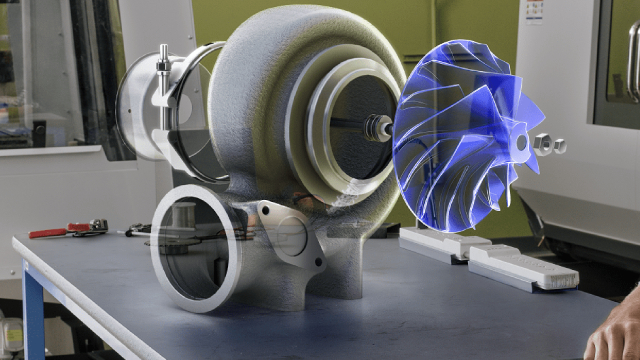

ELGIN, Ill.--(BUSINESS WIRE)--The Middleby Corporation (NASDAQ: MIDD), a leading worldwide manufacturer of equipment solutions for commercial foodservice, food processing, and residential kitchens, today announced the acquisition of Oka-Spezialmaschinenfabrik GmbH & Co. KG (Oka), expanding its portfolio of Middleby Food Processing equipment innovations. Oka is a leading designer and manufacturer of industrial extrusion, molding, depositing and cutting industrial production equipment in bake.

Middleby Corporation MIDD is currently navigating the critical Adhishthana Guna Triads stage under the Adhishthana framework, and the outlook is far from encouraging. The structure forming on the charts suggests the stock could be headed for an extended period of sluggish and volatile movement, raising caution for investors.

MIDD beats Q2 estimates despite a 1.4% sales dip, as acquisitions offset organic declines; spin-off plans move forward.

The Middleby Corporation (NASDAQ:MIDD ) Q2 2025 Earnings Conference Call August 6, 2025 11:00 AM ET Company Participants Bryan E. Mittelman - Chief Financial Officer James K.

While the top- and bottom-line numbers for Middleby (MIDD) give a sense of how the business performed in the quarter ended June 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Middleby (MIDD) came out with quarterly earnings of $2.35 per share, beating the Zacks Consensus Estimate of $2.2 per share. This compares to earnings of $2.39 per share a year ago.

ELGIN, Ill.--(BUSINESS WIRE)--The Middleby Corporation (NASDAQ: MIDD), a leading worldwide manufacturer of equipment for the commercial foodservice, food processing, and residential kitchen industries, today reported net earnings for the second quarter of 2025. Tim FitzGerald, CEO of The Middleby Corporation said, “Our second quarter results reflect the economic uncertainty our customers continue to navigate in key end markets. Despite these headwinds, I'm proud of our team's continued executio.

ELGIN, Ill.--(BUSINESS WIRE)--The Middleby Corporation (NASDAQ: MIDD), a leading worldwide manufacturer of equipment for the commercial foodservice, food processing, and residential kitchen industries, today announced the acquisition of Frigomeccanica S.p.A, expanding its portfolio of Middleby Food Processing equipment innovations. Frigomeccanica is a global leader in equipment solutions for drying, defrosting, fermentation, refrigeration and preservation used in the food processing industry. B.

Middleby (MIDD) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.