MMM Stock Recent News

MMM LATEST HEADLINES

HON and MMM both face headwinds, but strong aerospace growth and rising estimates make the former the stronger 2025 bet.

MMM posts higher Q2 earnings and margin gains despite rising costs, lifting its 2025 EPS outlook on productivity and reorganization efforts.

ST. PAUL, Minn. , Aug. 15, 2025 /PRNewswire/ -- The 3M Board of Directors (NYSE:MMM) today declared a dividend on the company's common stock of $0.73 per share for the third quarter of 2025.

LOS ANGELES--(BUSINESS WIRE)---- $MMM--NEOG Investors Who Originally Held Shares in 3M Company Have Opportunity to Join Neogen Corporation Fraud Investigation with the Schall Law Firm.

On Aug. 7, 2025, 3M (MMM -1.46%) Group President Christian T. Goralski Jr. sold 6,165 shares of the conglomerate through multiple open-market transactions, as disclosed in a Form 4 filing with the Securities and Exchange Commission.

MMM stock is up 22.3% YTD, driven by strong segment growth and cost actions, but high debt and valuation weigh on near-term upside.

Dividend growth stocks are often viewed as some of the safest income investments. However, dividend growth does not guarantee that the dividend is safe. I share some popular high-yield dividend growth stocks whose dividend payouts are at risk of getting cut.

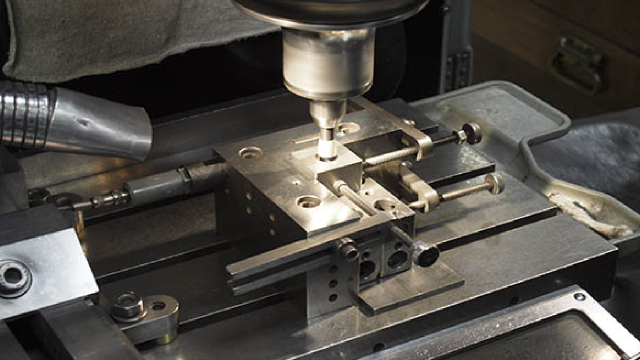

MMM's Transportation and Electronics unit posts 1% revenue growth in Q2 2025, fueled by aerospace and electronics gains despite market headwinds.

New facility addresses out-of-pocket classroom costs by providing free supplies to under-resourced teachers locally and nationwide LITTLE CANADA, Minn. , Aug. 7, 2025 /PRNewswire/ -- As many teachers continue to shoulder the burden of rising classroom supply costs—often spending 1-2 paychecks out of pocket each year—Kids In Need Foundation (KINF), a national nonprofit focused on supporting under-resourced teachers and students, is proud to announce the grand opening of its new national headquarters and expanded Teacher Resource Center in Little Canada, Minnesota.

MMM's Safety and Industrial unit posts fifth straight quarter of growth, fueled by demand in safety and electrical markets.