MPWR Stock Recent News

MPWR LATEST HEADLINES

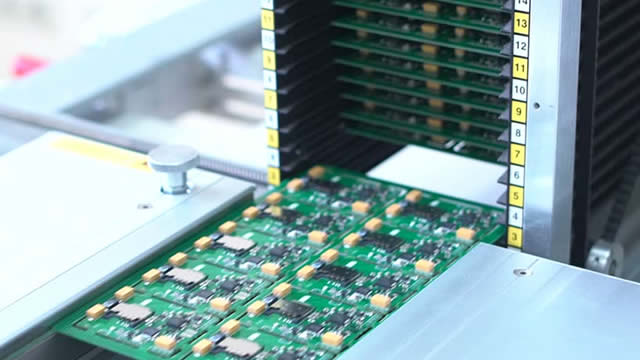

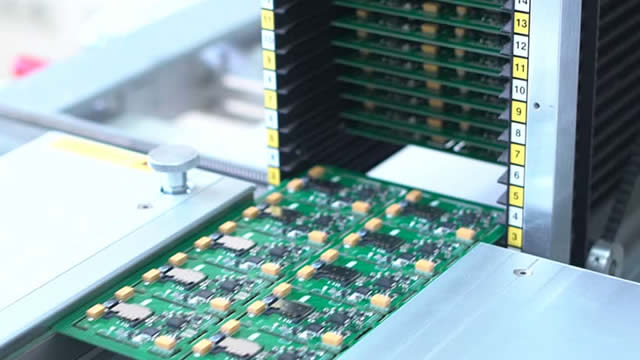

KIRKLAND, Wash., May 01, 2025 (GLOBE NEWSWIRE) -- Monolithic Power Systems, Inc. (“MPS”) (Nasdaq: MPWR), a fabless global company that provides high-performance, semiconductor-based power electronics solutions, today announced financial results for the quarter ended March 31, 2025.

KIRKLAND, Wash., May 01, 2025 (GLOBE NEWSWIRE) -- MPS will report its results after the market closes on May 1, 2025 and host a question-and-answer webinar at 2:00 p.m. PT / 5:00 p.m. ET. The live event will be held via a Zoom webcast, which can be accessed at https://mpsic.zoom.us/j/92570889542.

Monolithic Power Systems is a high-quality, fabless semiconductor company that easily gets overshadowed by the Nvidias of the world. MPWR is increasing shareholder yield and in a growing industry. The stock is down nearly 40% from its all-time high, presenting a buying opportunity for a company benefiting from secular growth trends in AI, EV, and data centers.

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Monolithic (MPWR), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended March 2025.

MPWR is expected to report solid results in the first quarter of 2025, driven by healthy demand in multiple verticals.

Monolithic (MPWR) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

This portfolio focuses on generating a growing stream of dividend income by investing in companies that consistently increase dividends. I reinvest dividends into more shares of the companies I already own to compound growth. The investment strategy is guided by specific principles to ensure consistent and disciplined investing.

Kirkland, Wash., April 16, 2025 (GLOBE NEWSWIRE) -- Monolithic Power Systems, Inc. (MPS) (Nasdaq: MPWR), a fabless global company that provides high-performance, semiconductor-based power electronics solutions, today announced plans to report its financial results for the first quarter ended March 31, 2025.

The Zacks Earnings ESP is a great way to find potential earnings surprises. Why investors should take advantage now.

Live Updates Live Coverage Has Ended Broader Markets for the Win 2:41 pm by Gerelyn Terzo The broader markets are headed for the win column, with the S&P 500 currently gaining 1.5% alongside a rising Dow Jones Industrial Average and Nasdaq Composite. If the gains hold, the S&P 500 is on pace for a 5.4% gain this week after taking investors on a roller coaster ride. China is looking ready to negotiate on tariffs, filling in the missing piece of the tariff puzzle that has kept things interesting this week. Newmont Mining (NYSE: NEM) and Monolithic Power (Nasdaq: MPWR) are the top gainers of the day, while Texas Instruments (Nasdaq: TXN) and Intel (Nasdaq: INTC) are laggards. First quarter earnings season is officially underway, which could insert another round of uncertainty. JPMorgan CEO Jamie Dimon warned that corporate America would be revising their outlooks downward. But for now, the markets will take the win. Stocks Show Backbone 12:30 pm by Gerelyn Terzo The broader market