MRK Stock Recent News

MRK LATEST HEADLINES

Merck stock is down 14% this year as Keytruda-led growth gets offset by Gardasil weakness and looming patent risks, which cloud the outlook.

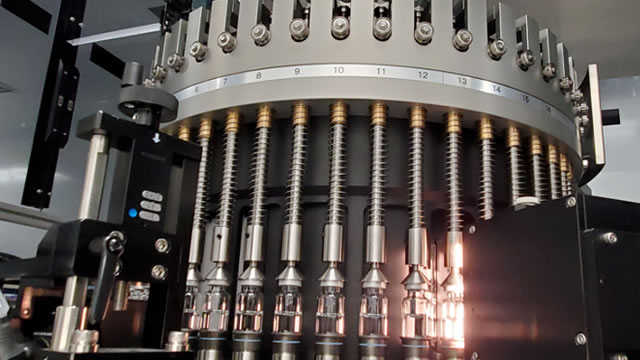

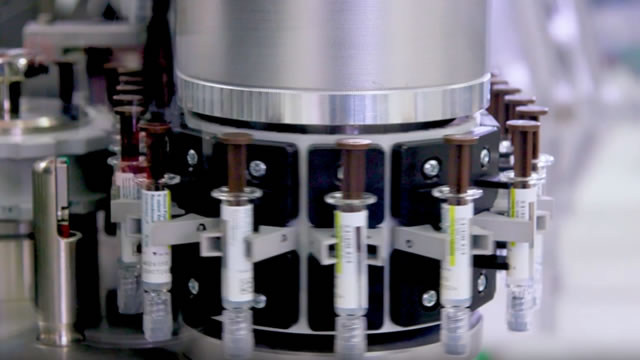

Drugmaker Merck said on Thursday that its pneumonia shot showed strong immune responses in children and teens who are at higher risk of serious illness, based on results from a late-stage study presented at a vaccines meeting in Lisbon.

RAHWAY, N.J.--(BUSINESS WIRE)---- $MRK #MRK--CAPVAXIVE Demonstrates Positive Immune Responses in Children and Adolescents at Increased Risk of Pneumococcal Disease.

Britain defended its record on attracting investment on Thursday after U.S. drugmaker Merck said it was abandoning a new London research centre and a top industry lobby group warned a challenging business environment was hurting the sector.

Britain's ambition to become a global science powerhouse has suffered a major setback after Merck, known in Europe as MSD, abandoned plans for a £1 billion research hub in London. About 125 scientists will lose their jobs as the US drugmaker closes laboratories near King's Cross and at the Francis Crick Institute by the end of 2025.

Merck said on Wednesday it was scrapping research operations in London, citing the UK's challenging business environment.

The U.S. Food and Drug Administration will send out around 100 cease-and-desist enforcement notices and thousands of letters warning pharmaceutical companies that direct-to-consumer ads must comply with regulations that are already on the books, senior administration officials said on Tuesday.

MRK expects strong Keytruda sales, new drug launches and $3B in planned cost savings to offset pressure from declining Gardasil sales and other headwinds.

Merck & Co., Inc. (NYSE:MRK ) Morgan Stanley 23rd Annual Global Healthcare Conference September 8, 2025 2:35 PM EDT Company Participants Robert Davis - Chairman, President & CEO Eliav Barr - Chief Medical Officer & Head of Global Clinical Development of Merck Research Laboratories Conference Call Participants Terence Flynn - Morgan Stanley, Research Division Presentation Terence Flynn Equity Analyst Good afternoon, everybody. We're going to get started here.

5 Relatively Secure And Cheap Dividend Stocks, Yields Up To 9% (Sept. 2025)