MRVL Stock Recent News

MRVL LATEST HEADLINES

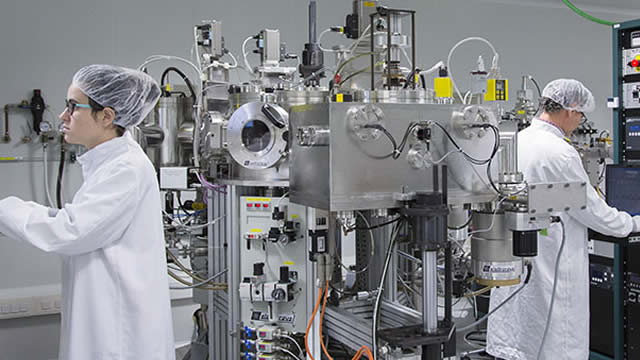

In the race to power artificial intelligence (AI), some of the most essential players operate just outside the spotlight. Marvell Technology NASDAQ: MRVL is a prime example.

Zacks.com users have recently been watching Marvell (MRVL) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Although the revenue and EPS for Marvell (MRVL) give a sense of how its business performed in the quarter ended April 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Q1 Net Revenue: $1.895 billion, a new record, grew by 63% year-on-year Q1 Gross Margin: 50.3% GAAP gross margin; 59.8% non-GAAP gross margin Q1 Diluted income per share: $0.20 GAAP diluted income per share; $0.62 non-GAAP diluted income per share SANTA CLARA, Calif. , May 29, 2025 /PRNewswire/ -- Marvell Technology, Inc. (NASDAQ: MRVL), a leader in data infrastructure semiconductor solutions, today reported financial results for the first quarter of fiscal year 2026.

Chris Versace joins Diane King Hall at the NYSE to chew through the macro headlines weighing on equities. From the Moody's credit downgrade to Fed speakers, Chris says the U.S. central bank "still has things to digest" as investors look for rate cut guidance.

Marvell Custom Silicon with NVIDIA NVLink Fusion Delivers Greater Flexibility for AI Infrastructure and Accelerates Time to Deployment SANTA CLARA, Calif. , May 19, 2025 /PRNewswire/ -- Marvell Technology, Inc.

Marvell (MRVL) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Calgary, Alberta--(Newsfile Corp. - May 12, 2025) - Marvel Biosciences Corp. (TSXV: MRVL) and its wholly owned subsidiary, Marvel Biotechnology Inc. (collectively the "Company" or "Marvel"), announces that, further to its press releases of March 28, 2025 and May 2, 2025, it has closed its non-brokered private placement (the "Offering"). Pursuant to the Offering, the Company issued an aggregate of 8,150,000 units (the "Units") at a price of $0.125 per Unit for aggregate gross proceeds of $1,018,750 (the "Offering").

Marvell Technology (NASDAQ:MRVL) shares descended 10% after the semiconductor services company postponed its investor day from next month until sometime next year, citing uncertainties in the macroeconomic environment. The event had been scheduled for June 10, but the company will instead host a webinar on June 17, 2025, focused on custom silicon technology for artificial intelligence (AI) infrastructure.

Recently, Zacks.com users have been paying close attention to Marvell (MRVL). This makes it worthwhile to examine what the stock has in store.