MSM Stock Recent News

MSM LATEST HEADLINES

MELVILLE, NY AND DAVIDSON, NC / ACCESS Newswire / August 27, 2025 / MSC INDUSTRIAL SUPPLY CO. (NYSE:MSM), a leading North American distributor of a broad range of metalworking and maintenance, repair and operations ("MRO") products and services, today announced the following upcoming investor event: Jefferies Industrials Conference When: September 3, 2025 Attendees: Erik Gershwind, CEO Ryan Mills, Head of Investor Relations Fireside Chat: Wednesday, September 3, 2025, at 2:50 p.m.

MSC Industrial (MSM) has been upgraded to a Zacks Rank #1 (Strong Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

CHARLOTTE, N.C. , Aug. 4, 2025 /PRNewswire/ -- Sealed Air Corporation (NYSE: SEE) today announced Kristen Actis-Grande will join the company as Chief Financial Officer, effective August 25, 2025.

MELVILLE, N.Y. and DAVIDSON, N.C.

Here is how MSC Industrial (MSM) and Siemens AG (SIEGY) have performed compared to their sector so far this year.

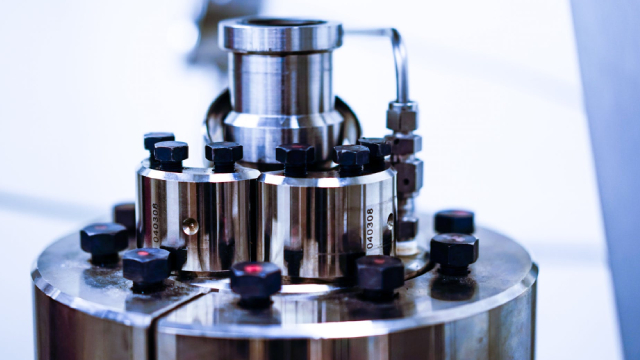

Revenue recovery from digital growth, high-touch solutions (In-Plant + vending), and improving SMB segment. Margin upside from price hikes, cost savings, and better operating leverage. Attractive valuation vs. peers with solid 3.89% dividend yield.

WIT, AB and MSM made it to the Zacks Rank #1 (Strong Buy) income stocks list on July 14, 2025.

Does MSC Industrial (MSM) have what it takes to be a top stock pick for momentum investors? Let's find out.

The Zacks Industrial Services industry has a promising near-term outlook, with stocks such as SIEGY, MSM and EOSE standing out as compelling portfolio additions.