MSTR Stock Recent News

MSTR LATEST HEADLINES

Strategy Inc. delivered a massive Q2 earnings beat, driven by its aggressive Bitcoin accumulation and rising Bitcoin prices. Management raised Bitcoin yield guidance to 30% for the year, with expectations of significant earnings growth if Bitcoin rallies to $150,000. Strategy shares offer leveraged exposure to Bitcoin at an attractive mNAV multiple, presenting a compelling entry point for bullish investors.

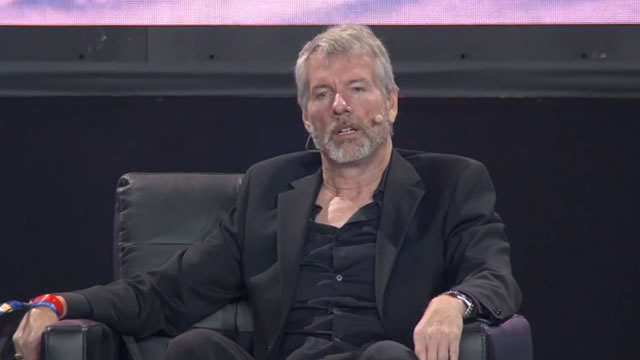

Michael Saylor, Strategy executive chairman, joins 'Squawk Box' to discuss the company's quarterly earnings results, the company's bitcoin stockpile, state of crypto, and more.

Since our last article, we have since tracked six new preferred stock and exchange traded debt offerings, with yields ranging from 6.5% to 9.875%. Here is a comparison against the highest quality preferred stocks in our coverage universe, as ranked by our internal “Compliance Score” metric: ETDs and preferreds ranked 10 out of 10 are meanwhile selling for an average discount to par of about 3% and offer an average current yield of 6.8%.

MicroStrategy's quarterly operating profit balloons to $14 billion, thanks to a rule change and bitcoin's rally.

Strategy reported its first profit in six quarters on Thursday, as the biggest corporate holder of bitcoin benefited from a remarkable quarter for cryptocurrencies.

Amazon (AMZN) earnings kick off a busy Thursday slate with an initial downside reaction. Alex Coffey and Scott Durfey join Marley Kayden for immediate reaction to the print.

TYSONS CORNER, Va.--(BUSINESS WIRE)--Strategy™ (Nasdaq: MSTR; STRK; STRF; STRD; STRC) today announced that it has entered into a sales agreement pursuant to which Strategy may issue and sell shares of its Variable Rate Series A Perpetual Stretch Preferred Stock, $0.001 par value per share (the “STRC Stock”), having an aggregate offering price of up to $4.2 billion (the “ATM Program”). Strategy expects to make sales of STRC Stock pursuant to the ATM Program in a disciplined manner over an extend.

TYSONS CORNER, Va.--(BUSINESS WIRE)--MicroStrategy® Incorporated d/b/a Strategy™ (Nasdaq: MSTR/STRK/STRF/STRD/STRC) (“Strategy” or the “Company”), the largest corporate holder of bitcoin and the world's first Bitcoin Treasury Company, today announces financial results for the three-month period ended June 30, 2025 (the second quarter of its 2025 fiscal year). “In the second quarter and into July, Strategy delivered another period of exceptional execution and growth. We expanded our bitcoin hold.

Investing in index funds is a safe way to grow your portfolio over the years. But there's a huge advantage to picking individual stocks: Your returns can be massive and life-changing.

Jenny Horne and Nate Peterson dive into this week's cryptocurrency movers including Coinbase (COIN). The company announced a partnership with JPMorgan Chase (JPM) ahead of its earnings report.