NGD Stock Recent News

NGD LATEST HEADLINES

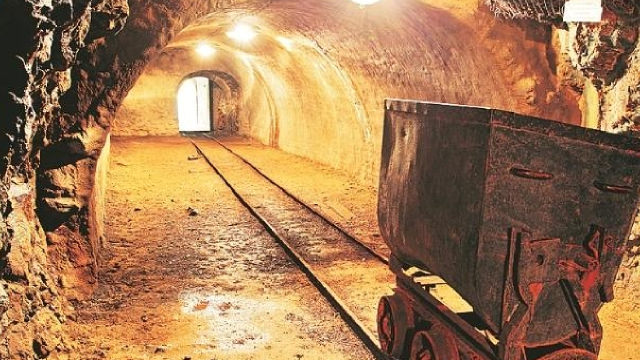

New Gold had a solid Q1-25 performance despite being the weakest quarter of the year, reporting positive free cash flow and better-than-expected operational results at New Afton. Importantly, C-Zone remains on track to ramp up by early 2026, allowing for exponential growth in free cash flow generation, with Rainy River moving into higher grades with stripping complete. In this update, we'll dig into the Q1 results, recent developments, and whether NGD is offering an adequate margin of safety at current levels.

(All dollar figures are in US dollars unless otherwise indicated) TORONTO , May 1, 2025 /PRNewswire/ - New Gold Inc. ("New Gold" or the "Company") (TSX: NGD) (NYSE American: NGD) is pleased to announce that the previously announced agreement with Ontario Teachers' Pension Plan ("Ontario Teachers'") to acquire the remaining 19.9% free cash flow interest in the Company's New Afton Mine ("New Afton") (the "Transaction") has now closed. The Company has now fully consolidated its free cash flow interest in New Afton to 100% and terminated all existing agreements with respect to Ontario Teachers' free cash flow interest in New Afton.

New Gold (NGD) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

New Gold Inc. (NYSE:NGD ) Q1 2025 Earnings Conference Call April 30, 2025 8:30 AM ET Company Participants Ankit Shah – Executive Vice President-Strategy and Business Development Keith Murphy – Executive Vice President and Chief Financial Officer Patrick Godin – President and Chief Executive Officer Luke Buchanan – Vice President-Technical Services Conference Call Participants Michael Siperco – RBC Capital Markets Lawson Winder – Bank of America Eric Winmill – Scotiabank Jeremy Hoy – Canaccord Genuity Mohamed Sidibé – National Bank Financial Operator Good morning. My name is Jester, and I will be your conference operator today.

Solid Quarterly Performance Leads to Free Cash Flow Generation, Critical Path Items Achieved to Allow for Ramp-up in Production and Exploration Activities Going Forward (All amounts are in U.S. dollars unless otherwise indicated) TORONTO , April 29, 2025 /PRNewswire/ - New Gold Inc. ("New Gold" or the "Company") (TSX: NGD) (NYSE American: NGD) today reported financial and operating results for the quarter ended March 31, 2025. "The first four months of the year have been exceptionally positive for New Gold in achieving our strategic objectives," stated Patrick Godin, President and CEO.

New Gold (NGD) possesses solid growth attributes, which could help it handily outperform the market.

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

NGD is likely to deliver a year-over-year decline in first-quarter 2025 earnings due to lower production levels for both gold and copper, somewhat negated by higher prices.

New Gold (NGD) reachead $3.68 at the closing of the latest trading day, reflecting a +1.1% change compared to its last close.

In the latest trading session, New Gold (NGD) closed at $3.59, marking a +0.56% move from the previous day.