NI Stock Recent News

NI LATEST HEADLINES

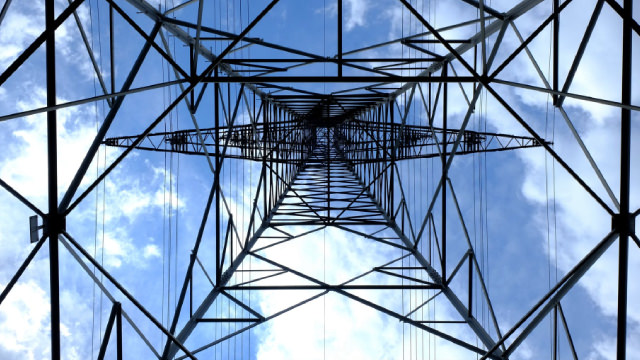

Utility stocks like AVA, CMS, NI and CNP are a safe bet amid growing concerns of a slowing economy.

NI makes a strong case for investment given its solid earnings growth prospects, increasing investments and capability to increase shareholders' value through dividends.

Defensive stocks like CMS, NI, CNP, TAP and CSV are safe bets during times of market volatility.

NI and CNP work efficiently and continue to provide reliable services to their expanding customer base.

Five low-beta high-yielding stocks have strong growth potential for 2025. These are: AEE, ATO, AWK, ETR, NI.

MERRILLVILLE, Ind.--(BUSINESS WIRE)--NiSource announces transition to Investor Relations leadership.

Low-beta utility stocks like NI, ATO, SWX and ETR are a safe bet during times of market turmoil.

Transitioning to retirement income requires careful portfolio calibration to avoid investment mistakes, as there are no or limited alternative income sources to compensate for errors. Key risks to avoid are income cuts and outliving the asset base, which can lead to reduced consumption standards or increased longevity risk. Mitigating these risks is crucial, but achieving the necessary income or portfolio size efficiently is equally important.

Low-beta utility and consumer staple stocks like PNW, NI, ATO, TSN and TAP are a safe bet during times of market volatility.

Utility stocks like NI, ATO, AWK and NJR are a safe bet during times of market volatility.