NOW Stock Recent News

NOW LATEST HEADLINES

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Bill McDermott, ServiceNow CEO, joins 'Power Lunch' to discuss how Oracle's blowout quarter impacts ServiceNow, how AI continues to drive the company's business and much more.

ServiceNow's superior revenue and AI momentum, especially with Now Assist, position it for stronger long-term growth than Salesforce. Despite Salesforce's higher margins, its revenue growth and AI adoption lag behind ServiceNow, limiting its upside potential. Valuation models suggest ServiceNow offers 30% upside versus Salesforce's 16%, justifying a higher premium for ServiceNow shares.

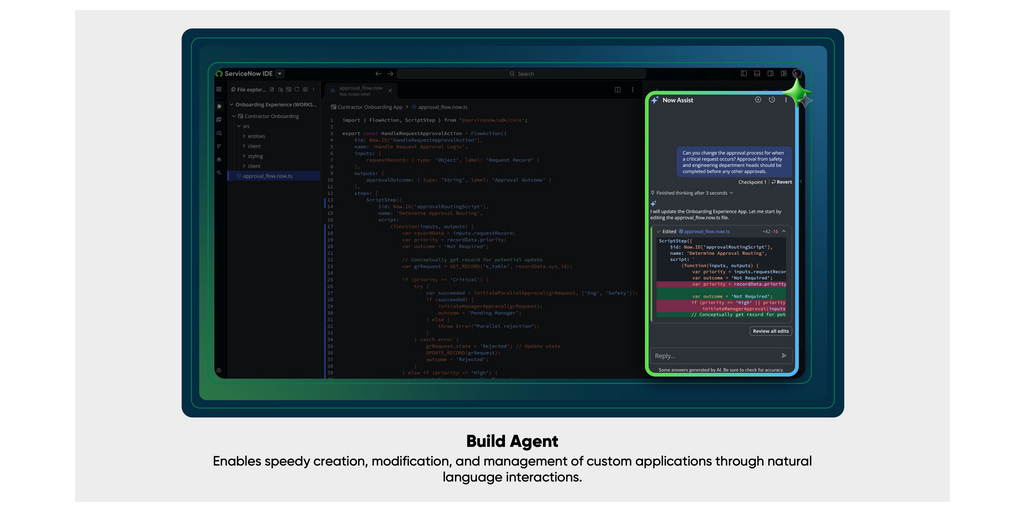

SANTA CLARA, Calif.--(BUSINESS WIRE)--ServiceNow supercharges AI adoption for enterprises with secure, scalable AI platform.

NASHVILLE, Tenn.--(BUSINESS WIRE)--Today at Xperience 2025, Genesys®, a global cloud leader in AI-Powered Experience Orchestration, announced an expanded strategic partnership with ServiceNow®. Together, they will deliver new Agent2Agent (A2A) orchestration, enabling customers to self-serve across the enterprise by making it possible for AI agents to autonomously collaborate on interactions and tasks, fueling greater operational efficiency and consumer loyalty. As agentic AI redefines the custo.

In the latest trading session, ServiceNow (NOW) closed at $940.34, marking a +2.9% move from the previous day.

NOW expands with a GSA deal offering federal agencies up to 70% discounts as workflow adoption drives subscription growth.

Software providers are offering the federal government big discounts amid the Trump administration's push toward adopting AI tools. Hilary Frisch, senior research analyst at ClearBridge Investments, discusses why government contracts are a big opportunity for software providers.

Investors interested in stocks from the Computers - IT Services sector have probably already heard of Leidos (LDOS) and ServiceNow (NOW). But which of these two companies is the best option for those looking for undervalued stocks?

ServiceNow's partner-driven innovation fuels 22.4% revenue growth and a raised 2025 subscription outlook despite stiff competition.