ORCL Stock Recent News

ORCL LATEST HEADLINES

Oracle surged to new highs on major contract wins, signaling strong future growth despite recent earnings miss. AI and tech stocks like AVGO and NBIS rallied on large customer acquisitions, while ADBE lagged due to monetization concerns.

Charles Bobrinskoy, Ariel investments vice chairman and head of investment group, joins 'The Exchange' to discuss why he trimmed Oracle despite it's recent stock surge.

It's not often that a stock absolutely skyrockets right after it misses analysts' expectations for both revenue and profits, but that was what Oracle (ORCL -4.50%) did following its recent fiscal 2026 first-quarter report. The market's excitement about the stock appeared to stem from the company's growing cloud computing business.

Oracle Corporation shares surged 40% on remaining performance obligations up 359% and cloud infrastructure growth guidance raised to 77% from 70%. ORCL's multicloud strategy and major AI partnerships, including a $300B OpenAI deal, are legs of AI optimism, but expectations may be running ahead of fundamentals. Despite robust cloud and AI momentum, Oracle still missed top and bottom line estimates, and its valuation is now at dot-com era highs, signaling overextension.

Matt Tuttle swings by Morning Movers to look at this week's tremendous move higher for Oracle (ORCL). Matt says you don't get a ton of alpha by owning Nvidia (NVDA) here and he thinks Oracle is over-extended currently, but longer-term says both are still "must-owns.

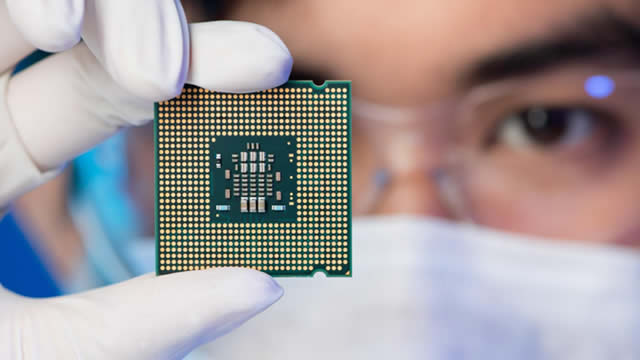

Growth stocks are thriving in 2025 thanks to artificial intelligence (AI), deregulation, and looming rate cuts. While Nvidia (NVDA) grabs headlines as the AI chip king, smart investors are finding opportunities in companies building the infrastructure layer that makes AI possible.

The world's largest startup needs more paying users to help finance its ambitions, but researchers and consultants aren't sure they will materialize soon.

Bulls remain in control of the market in the short-term, and the price action is telling them to stay long for now. While investors should continue to be vigilent about seasonality and a potential post-FOMC pullback, price remains king.

Technology companies have remained the craze over recent years, with the Mag 7 group significantly thrusting the market higher on the back of the AI frenzy.

The ChatGPT maker has a big appetite for expensive data center capacity.