PFE Stock Recent News

PFE LATEST HEADLINES

Shares in Pfizer and Moderna fell 3.9% and 7.4%, respectively.

Sixteen of the thirty-eight highest-yield, 'safer' S&P 500 dividend stocks are highlighted as ready to buy, with adequate free cash flow supporting payouts. Analyst forecasts suggest top ten S&P 500 dividend 'dogs' could deliver 20.45% to 38.5% net gains by September 2026, with an average gain of 27.35%. Stocks like Amcor, Healthpeak, Conagra, Pfizer, and Verizon offer the best combination of high yield and low price, following the O'Higgins 'Dogs of the Dow' strategy.

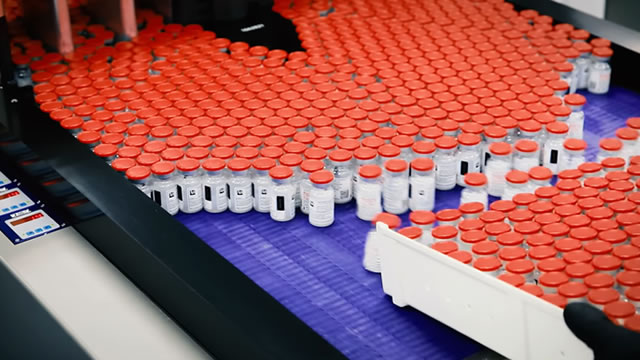

Shares of companies that make COVID vaccines sank Friday, after a report raised fears that Trump administration health officials will blame the vaccines for some child deaths.

Shares of Pfizer and Moderna fell on Friday after a report that Trump administration health officials plan to link Covid vaccines to the deaths of 25 children. The report comes as Health and Human Services Secretary Robert F.

CNBC's Angelica Peebles joins 'Money Movers' to discuss Trump officials reported plan to link child deaths to covid shots.

Pfizer's late-stage pipeline, from oncology blockbusters to mRNA vaccines, positions it for long-term growth despite recent setbacks.

In the most recent trading session, Pfizer (PFE) closed at $24.83, indicating a +1.04% shift from the previous trading day.

Pfizer achieved 10% year-over-year Q2 2025 revenue growth to $14.7 billion, driven by Abrysvo RSV vaccine and Seagen-acquired oncology assets. Management expects over $20 billion in risk-adjusted revenue from new launches by 2030, offsetting $17–$20 billion in patent expirations. R&D investment of ~$11 billion in 2025 supports 28 Phase 3 programs across oncology, vaccines, inflammation, and rare diseases.

In the Large-Cap Pharmaceuticals industry, Lilly, J&J, Novartis, Pfizer and Bayer are worth retaining amid macro pressure and rising innovation.

Dividend stocks have long been a favorite for investors seeking both income and long-term growth. By combining regular cash payouts with potential stock appreciation, dividend-paying companies provide a reliable way to generate passive income while building wealth. Historically, dividends have played a critical role in overall returns, accounting for nearly one-third of the S&P 500’s total gains since 1926. With interest rates expected to decline later this year, high-yield dividend stocks are becoming even more attractive to investors. The appeal of these stocks lies in their ability to deliver steady income streams while helping offset rising costs for housing, insurance, and other expenses. In addition, dependable dividend payments allow investors to reinvest or allocate money toward retirement savings, making them a powerful tool for financial stability. High-quality blue-chip companies that consistently pay dividends are especially valuable, as they offer both security and l