PLAB Stock Recent News

PLAB LATEST HEADLINES

Analyzing a company's cash position reveals its true financial health, making DXPE, PLAB, GCT and AVO with growing cash flows attractive buys.

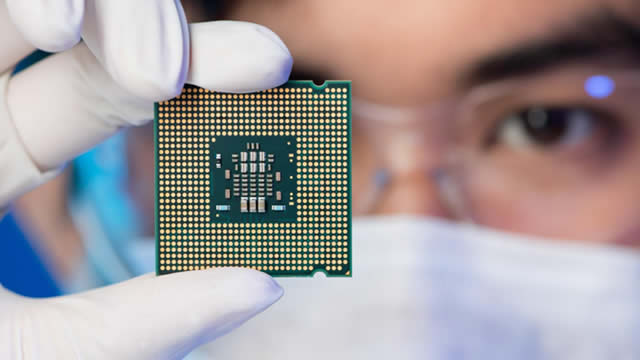

PLAB is an attractive stock for value-oriented investors, given the growing demand for its chips in AI, IoT, 5G and consumer products.

BROOKFIELD, Conn., Jan. 10, 2025 (GLOBE NEWSWIRE) -- Photronics, Inc. (Nasdaq: PLAB), a worldwide leader in photomask technologies and solutions, announced today the appointment of George Macricostas to the position of Executive Chairman, effective January 6, 2025.

Cash offers strength, vitality and flexibility to a company and hence, PLAB, DXPE, CLMB and GPRK with rising cash flows are worth buying.

BROOKFIELD, Conn., Jan. 02, 2025 (GLOBE NEWSWIRE) -- Photronics, Inc. (Nasdaq:PLAB), a worldwide leader in photomask technologies and solutions, is scheduled to present at the 27th Annual Needham Growth Conference on Tuesday, January 14, 2025 at 4:30 p.m. Eastern Time at the Lotte NY Palace hotel at 455 Park Avenue in NYC. A live and on-demand webcast of the presentation can be accessed on the “Investors” section of the Photronics website at www.photronics.com.

PLAB has been suffering from sluggish semiconductor industry trends. However, growing demand for its high-end ICs and cheap valuation make the stock a buy.

Photronics reported $223M in Q4-FY24 sales, surpassing guidance, with 5% IC and 7% FPD growth. The stock offers a 40% upside based on normalized PE and a 47% price-to-sales discount. Planned $200M 2025 CapEx focuses on U.S. capacity expansion and advanced technology node capabilities.

BROOKFIELD, Conn., Aug. 15, 2024 (GLOBE NEWSWIRE) -- Photronics, Inc. (Nasdaq:PLAB), a worldwide leader in photomask technologies and solutions, is scheduled to announce financial results for the third quarter of fiscal 2024 on Thursday, August 29, 2024, before the market opens.

Photronics, Inc. is a leading manufacturer of photomasks for semiconductors, with significant demand due to AI and IoT applications. Planned investments in IC capacity and efficiency in 2024 could drive FCF growth. The company is also expecting demand for its products thanks to supply chain regionalization and differentiation by design.

Tech stocks have long been the darlings of the investment world. But recent shifts in market dynamics have brought several to trade at what can only be described as deep discounts.