PNC Stock Recent News

PNC LATEST HEADLINES

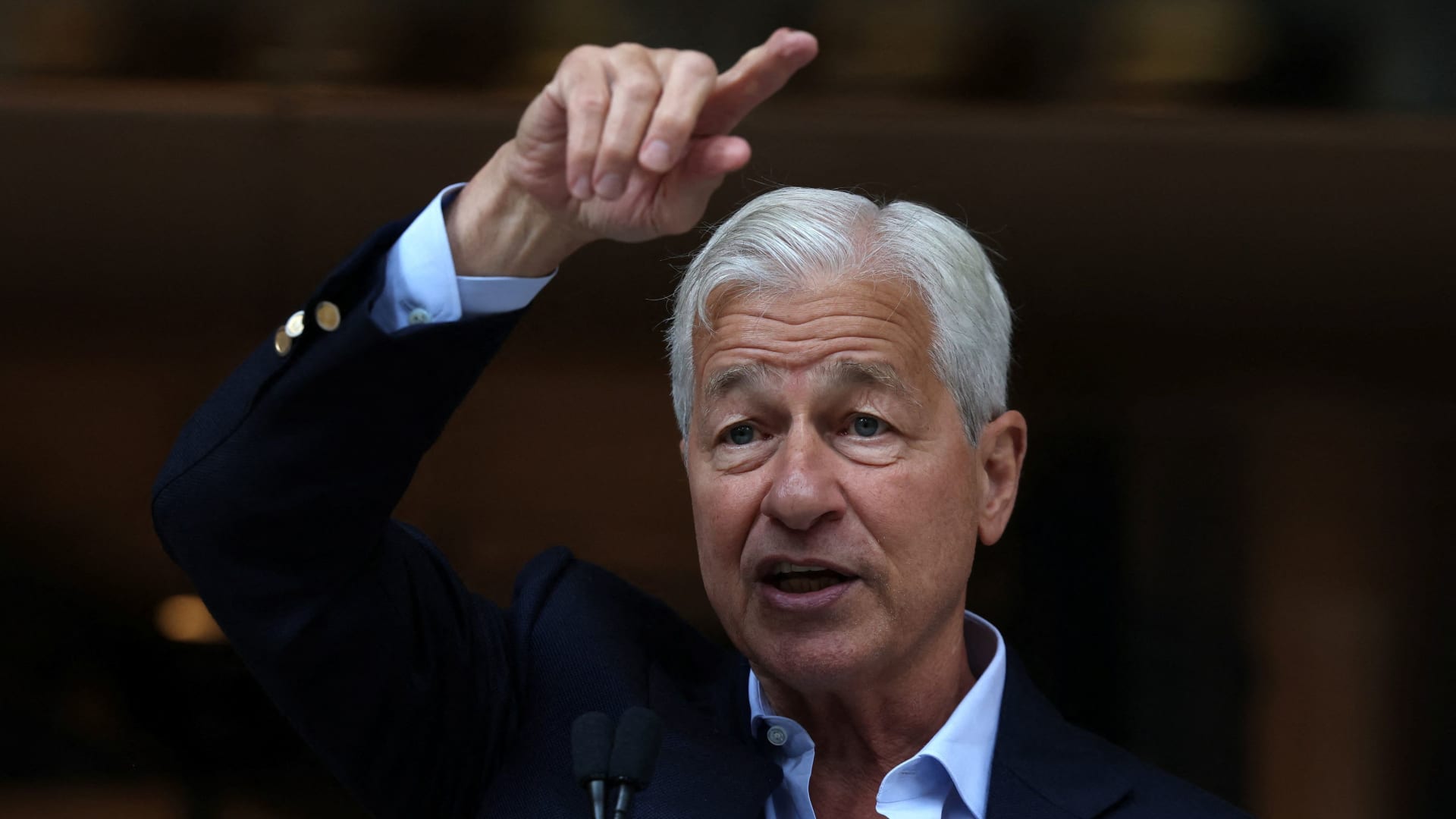

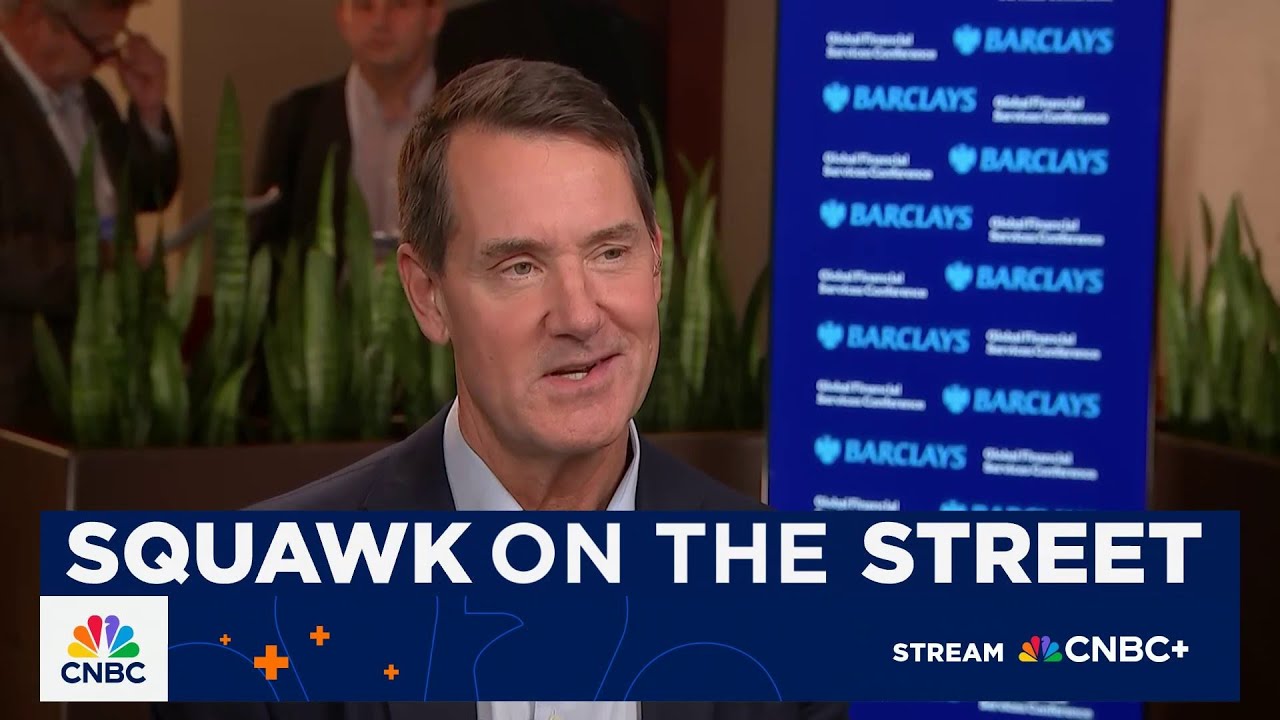

Amid economic uncertainty and a Bureau of Labor Statistics preliminary report revising down job numbers, CEOs weighed in this week on CNBC. Ranging from JPMorgan Chase CEO Jamie Dimon to PNC Financial Services CEO Bill Demchak, executives are starting to issue varying degrees of warning about slowdown.

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does The PNC Financial Services Group (PNC) have what it takes?

NEW YORK--(BUSINESS WIRE)-- #communitybanking--Charlotte McLaughlin joins Community Capital's Board to drive innovation, loan trading, origination, marketplace growth, and expanded partnerships.

PNC Financial agrees to acquire FirstBank in a $4.1B deal, aiming to boost scale and expand in Colorado and Arizona.

Bill Demchak, CEO of PNC, sits down with CNBC's Sara Eisen to discuss PNC's plans to buy FirstBank, expectations for future deals, outlooks on the consumer, and much more.

PNC is making its largest acquisition in four years as one dealmaker flags more tie-up meetings between banks.

PNC Financial Services Group Inc (NYSE:PNC) announced a definitive agreement to acquire Colorado-based FirstBank Holding Company, including its banking subsidiary FirstBank, in a $4.1 billion deal. The acquisition will expand PNC's footprint in Colorado and Arizona, adding to its retail and commercial banking presence in these fast-growing markets.

U.S. bank PNC Financial said on Monday it will buy Colorado-based FirstBank Holding in a $4.1 billion cash-and-stock deal.

Yung-Yu Ma, PNC Asset Management chief investment strategist, joins 'Money Movers' to discuss his market outlook amid weak job data and tariff uncertainty.

PITTSBURGH , Sept. 3, 2025 /PRNewswire/ -- The PNC Financial Services Group, Inc. (NYSE: PNC) expects to issue financial results for the third quarter 2025 at approximately 6:30 a.m.