PNW Stock Recent News

PNW LATEST HEADLINES

Pinnacle West Capital Corporation (NYSE:PNW ) Q2 2025 Earnings Conference Call August 6, 2025 11:00 AM ET Company Participants Amanda Ho - Director of Investor Relations Andrew D. Cooper - Senior VP & CFO Theodore N.

PNW second-quarter earnings decrease year over year, while revenues increase. Total operating expenses also rise during the same period.

Pinnacle West (PNW) came out with quarterly earnings of $1.58 per share, in line with the Zacks Consensus Estimate . This compares to earnings of $1.76 per share a year ago.

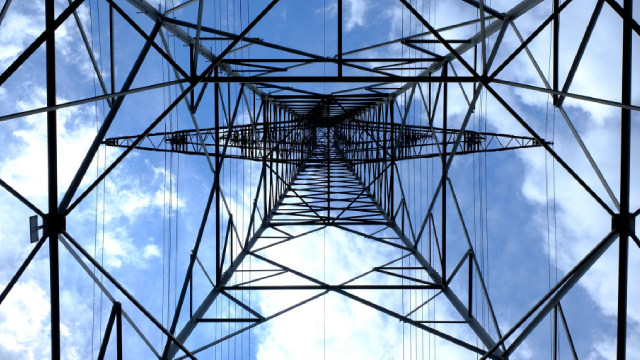

PHOENIX & TUCSON, Ariz.--(BUSINESS WIRE)--Arizona utilities announce commitment plans for Transwestern Pipeline's Desert Southwest expansion project.

PHOENIX--(BUSINESS WIRE)--Pinnacle West reported lower 2025 second-quarter financial results than it did in the same period a year ago.

Pinnacle West (PNW) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

PNW's Q2 performance is expected to have continued to benefit from retail electricity sales. Yet, higher depreciation and amortization might have offset some positives.

On 8/1/25, NRG Energy, Emera, and Pinnacle West Capital will all trade ex-dividend for their respective upcoming dividends. NRG Energy will pay its quarterly dividend of $0.44 on 8/15/25, Emera will pay its quarterly dividend of $0.725 on 8/15/25, and Pinnacle West Capital will pay its quarterly dividend of $0.895 on 9/2/25.

PHOENIX--(BUSINESS WIRE)--Pinnacle West Capital Corp. plans to release its 2025 second-quarter financial results before the U.S. financial markets open on Wed., Aug. 6, 2025.

Investors interested in stocks from the Utility - Electric Power sector have probably already heard of Portland General Electric (POR) and Pinnacle West (PNW). But which of these two stocks presents investors with the better value opportunity right now?