PPL Stock Recent News

PPL LATEST HEADLINES

PPL (PPL) came out with quarterly earnings of $0.60 per share, beating the Zacks Consensus Estimate of $0.53 per share. This compares to earnings of $0.54 per share a year ago.

Announces 2025 first-quarter reported earnings (GAAP) per share of $0.56. Achieves 2025 first-quarter ongoing earnings per share of $0.60 versus $0.54 in 2024.

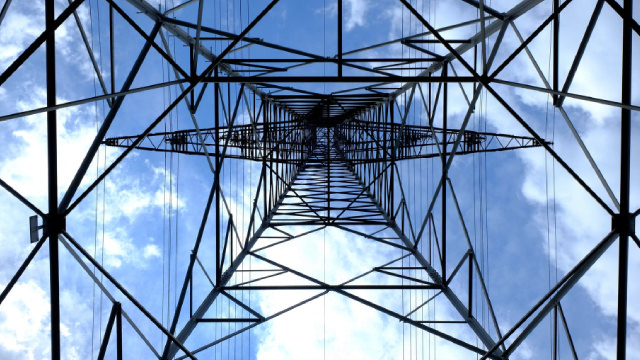

PPL and DUK represent the energy sector's evolving landscape, with utilities progressively transitioning to cleaner and more sustainable energy sources.

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for PPL (PPL), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended March 2025.

PPL's first-quarter results are expected to benefit from higher sales volume, smart investments to strengthen the grid and cost savings initiatives of the company.

The latest trading day saw PPL (PPL) settling at $36.25, representing a +0.03% change from its previous close.

PPL (PPL) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

PPL Corporation operates as a regulated utility in Rhode Island, Pennsylvania, and Kentucky, with a large customer base and stable revenue growth. Kentucky is the largest earnings contributor, while Pennsylvania shows potential due to new data centers supporting AI deployment. The company is investing more money in Kentucky over the next four years than elsewhere, but it is not neglecting Pennsylvania.

PPL, Xcel Energy and American Electric Power are included in this Analyst Blog.

Despite PPL's rising estimates and systematic expenditure to strengthen operations, our suggestion for investors is to wait and look for a better entry point, as the stock is trading at a premium.