PTON Stock Recent News

PTON LATEST HEADLINES

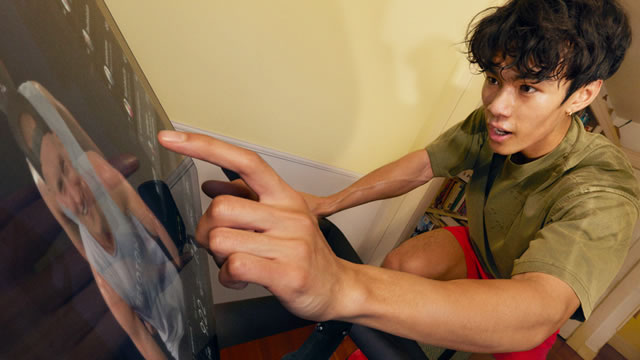

Consumer expectations, technology adoption and market competition are shifting as aging adults get more tech-savvy and demand connectivity with family and friends

Peloton Interactive, Inc. (NASDAQ:PTON ) Citi's 2025 Global Technology, Media and Telecommunications Conference September 3, 2025 10:10 AM EDT Company Participants Liz Coddington - Chief Financial Officer Conference Call Participants Ronald Josey - Citigroup Inc., Research Division Presentation Ronald Josey MD and Co-Head of Tech & Communications [Audio Gap] at Citi, and I'm always happy to have with us Peloton's CFO, Liz Coddington.

Peloton Interactive (PTON -2.12%) stock was demonstrating Phoenix-like qualities over the past few days, on the back of a media article that lit a fire under the stock. Week to date as of Friday before market open the company's stock had flown more than 8% higher in price, according to data compiled by S&P Global Market Intelligence.

Peloton reportedly plans to launch its integrated artificial intelligence (AI) platform and other new products as early as October. The fitness company is set to roll out the platform, an updated bike, a refreshed treadmill and new branded peripherals, Bloomberg reported Thursday (Aug. 14), citing unnamed sources.

Peloton Interactive (PTON -1.46%) went public in 2019 at $29 per share, and by December 2020 it had more than quintupled to a peak of around $163. Consumers were lining up to buy the company's at-home exercise equipment at the height of the pandemic so they could stay fit while lockdowns and social restrictions were in effect.

The average of price targets set by Wall Street analysts indicates a potential upside of 26.1% in Peloton (PTON). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock.

PTON, SFM, STKL, and BODI are tapping into an $11T wellness market, boosted by tech, nutrition, and holistic health trends.

Peloton (PTON 5.23%) had its initial public offering (IPO) in September 2019, and the stock has taken investors on a wild ride since its market debut. The stock had its public debut shortly before the coronavirus pandemic, whose related shelter-in-place and social-distancing conditions resulted in dramatic changes to daily life.

Key Points in This Article: Peloton Interactive's (PTON) stock surged 198% from its 52-week low with a 10.3% jump on August 8, after Goldman Sachs upgraded it to buy with a $11.50 price target.

Over the past 12 months, the S&P 500 rallied more than 20%. It is hovering near its all-time high and looks historically expensive at 29 times its trailing earnings -- so this might not be the best time to hunt for bargain stocks.