PYPL Stock Recent News

PYPL LATEST HEADLINES

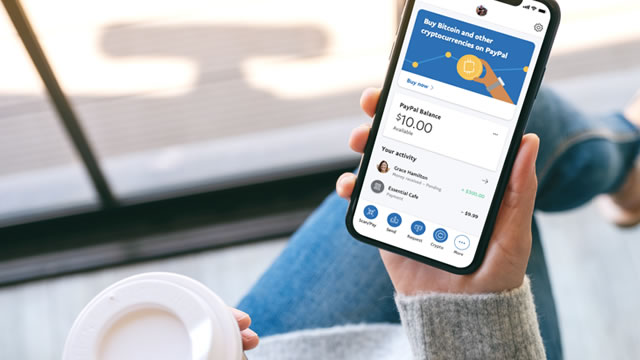

PayPal stock is lagging rivals in 2025, but strong BNPL gains and global expansion hint at potential upside ahead.

Crypto investors are contemplating a "stablecoin summer" in the wake of the GENIUS Act, which passed with 68-30 Senate support last week and now moves to the House of Representatives for further consideration. While the bill still needs to pass the House, several revisions have been included in the current version to garner support from both Democratic and Republican teams, and it's widely expected that President Trump will sign it into law if the House votes in favor.

The investing world has taken note that investing legend Warren Buffett has been a net seller of stocks for the past 10 quarters. But it's worth noting that even amid that shift, he still found stocks he wanted to buy, like Domino's Pizza and Pool Corp.

PayPal is prioritizing quality growth by shifting away from unprofitable volume, which pressures gross revenue but boosts transaction margin dollars. Despite slow top-line growth and market skepticism, PayPal trades at historically low multiples, offering significant upside potential as fundamentals outpace valuation. Aggressive share buybacks, robust free cash flow, and a resilient competitive moat position PayPal for double-digit EPS growth and long-term value creation.

PayPal CEO Alex Chriss said the fintech's buy now, pay later business is "growing very quickly," especially with college students and young people. "It's becoming the way that people want to spend," Chriss said Thursday.

PayPal CEO Alex Chriss said Thursday that the fintech's deal with the Big 12 Conference to pay student-athletes through its platform was a "natural partnership" because college students are already users of PayPal and Venmo.

PayPal CEO Alex Chriss and Big 12 Conference Commissioner Brett Yormark join 'Squawk Box' to discuss the company's partnership with Big Ten and Big 12 conferences to enable college athletic departments to pay their student-athletes directly through the financial platform.

Multi-year partnerships will bring PayPal and Venmo to college campuses nationwide SAN JOSE, Calif. , June 26, 2025 /PRNewswire/ -- PayPal Holdings, Inc. (NASDAQ: PYPL), a global leader in payments, today announced multi-year agreements with the Big Ten and Big 12 Conferences that will modernize the distribution of institutional payments from universities to student-athletes in a new revenue-sharing model.

A new partnership between the Big Ten and Big 12 conferences and PayPal will allow student-athletes to receive their compensation via the fintech company.

COIN and PYPL push deeper into stablecoins and crypto payments, but one shows stronger financial momentum and growth.