QRVO Stock Recent News

QRVO LATEST HEADLINES

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

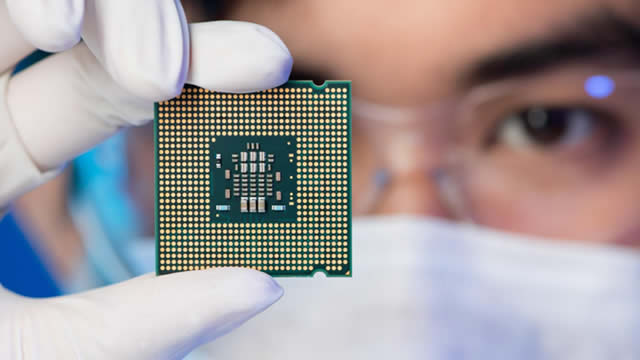

Qorvo delivered outstanding quarterly results, surpassing expectations with strong revenue, margin, and EPS beats, despite ongoing headwinds in China and strategic business shifts. Our growth is driven by expanding content at our largest customer, robust defense and aerospace demand, and leadership in Wi-Fi and power management solutions. Operational improvements, including facility closures and cost optimization, are set to further boost margins and free cash flow in coming years.

Qorvo's near-term upside from the Apple iPhone launch is largely priced in, limiting immediate catalysts for the stock. However, I see significant long-term potential in Qorvo's defense and aerospace segment, especially with rising US defense spending and new contract opportunities. Financials show solid earnings beats and strong forward guidance, but overall revenue growth remains challenged without new catalysts.

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Qorvo, Inc. (NASDAQ:QRVO ) Q1 2026 Earnings Conference Call July 29, 2025 4:30 PM ET Company Participants David Fullwood - Senior Vice President of Sales & Marketing Douglas DeLieto - Vice President of Investor Relations Frank P. Stewart - Senior VP & President of Advanced Cellular Grant A.

Qorvo (QRVO) came out with quarterly earnings of $0.92 per share, beating the Zacks Consensus Estimate of $0.62 per share. This compares to earnings of $0.87 per share a year ago.

QRVO faces a revenue drop this quarter, but innovation in broadband and radar tech may help offset the earnings impact.

Qorvo's Q1 results are expected to be quiet, with weak smartphone and automotive markets offset by growth in defense and aerospace segments. I'm closely watching management's guidance on mobile demand, 5G sales, and signs of recovery in global electronics, given heavy reliance on Apple. High-Performance Analog, especially defense and aerospace, is a bright spot with multi-year contracts and double-digit growth expected through 2026.

The rapid proliferation of the edge IoT, AI data centers and automotive electrification, as well as the adoption of WiFi 6E and WiFi 7, is enhancing the prospects of SWKS and QRVO despite challenging macroeconomic conditions.