QURE Stock Recent News

QURE LATEST HEADLINES

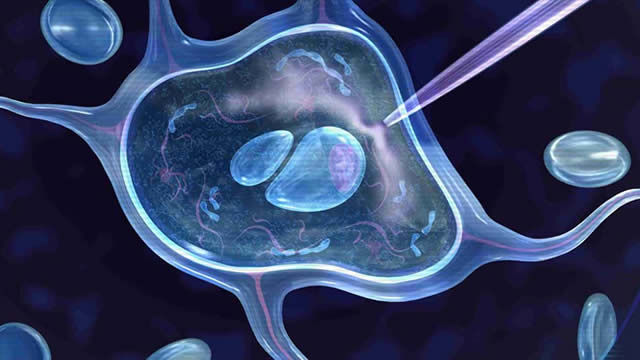

Investors interested in the Genomics and Synthetic Biology theme may consider adding these three stocks to their portfolio - Intellia Therapeutics (NTLA), uniQure (QURE) and Verve Therapeutics (VERV).

NORWOOD, Mass., May 19, 2025 (GLOBE NEWSWIRE) -- Corbus Pharmaceuticals Holdings Inc. (NASDAQ: CRBP), a clinical-stage company focused on oncology and obesity, today announced the appointment of Rachelle Jacques as Chair of its Board of Directors, effective May 15.

The consensus price target hints at a 161.5% upside potential for uniQure (QURE). While empirical research shows that this sought-after metric is hardly effective, an upward trend in earnings estimate revisions could mean that the stock will witness an upside in the near term.

uniQure N.V. (NASDAQ:QURE ) Q1 2025 Earnings Conference Call May 9, 2025 8:30 AM ET Company Participants Chiara Russo - Senior Director, Investor Relations Matt Kapusta - Chief Executive Officer Walid Abi-Saab - Chief Medical Officer Christian Klemt - Chief Financial Officer Conference Call Participants Luca Issi - RBC Debjit Chattopadhyay - Guggenheim Paul Matteis - Stifel Patrick Trucchio - H.C.

UniQure (QURE) came out with a quarterly loss of $0.82 per share versus the Zacks Consensus Estimate of a loss of $1.07. This compares to loss of $1.36 per share a year ago.

~ AMT-130 granted Breakthrough Therapy designation by FDA ~ ~ Initial safety data from third cohort of Phase I/II study show AMT-130 continues to be generally well-tolerated, with no treatment-related serious adverse events ~ ~ Held Type B FDA meetings in the first and second quarters of 2025 to advance BLA preparations for AMT-130; regulatory update expected in the second quarter of 2025 ~ ~ AMT-260 clinical data from first patient to be presented at Epilepsy Therapies & Diagnostics Development Symposium on May 29, 2025 ~ ~ Cash, cash equivalents and current investment securities of approximately $409.0 million as of March 31, 2025 expected to fund operations into second half of 2027 ~ ~ uniQure to host inaugural earnings call at 8:30 a.m. ET ~ LEXINGTON, Mass.

uniQure's lead program for Huntington's Disease is planning to file an application via the accelerated approval pathway. On Monday, May 5th, PTC Therapeutics announced positive results from their phase 2 Huntington's Disease trial. I compare the data from these two treatments and share my thoughts here.

~ uniQure to host inaugural earnings call on Friday, May 9, 2025 at 8:30 a.m. ET ~ ~ uniQure to host inaugural earnings call on Friday, May 9, 2025 at 8:30 a.m. ET ~

uniQure (QURE) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

uniQure's AMT-130 gene therapy for Huntington's Disease shows promising trial data, leading to significant stock price increases and potential for FDA accelerated approval. QURE's stock has seen volatility but has near-term catalysts like BLA submission and 36-month trial data, suggesting potential for immediate further gains. Despite competition from PTC518, AMT-130's effectiveness and one-time treatment advantage could drive substantial revenue and stock price growth.