RCI Stock Recent News

RCI LATEST HEADLINES

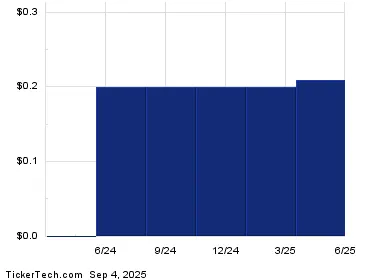

On 9/8/25, Alphabet, Becton, Dickinson, and Rogers Communications will all trade ex-dividend for their respective upcoming dividends. Alphabet will pay its quarterly dividend of $0.21 on 9/15/25, Becton, Dickinson will pay its quarterly dividend of $1.04 on 9/30/25, and Rogers Communications will pay its quarterly dividend of $0.50 on 10/3/25.

Schedule of activities below including Casa Loma Symphony Orchestra with E Street Band members Schedule of activities below including Casa Loma Symphony Orchestra with E Street Band members

Rogers Communications Inc. (RCI.B:CA) Bank of America 2025 Media, Communications & Entertainment Conference September 3, 2025 11:20 AM EDT Company Participants Anthony Staffieri - President, CEO & Director Glenn Brandt - Chief Financial Officer Conference Call Participants Matthew Griffiths - BofA Securities, Research Division Presentation Matthew Griffiths Associate Welcome Rogers back to the conference. So with us, we have CEO of Rogers, Tony Staffieri; and the CFO, Glenn Brandt.

HOUSTON--(BUSINESS WIRE)--RCI Hospitality Holdings, Inc. (Nasdaq: RICK) announced today it has declared a quarterly cash dividend of $0.07 per common share for the fiscal 2025 fourth quarter ending September 30, 2025. The 4Q25 dividend is payable September 30, 2025 to holders of record at the close of business September 16, 2025. This marks RCI's 39th consecutive quarter of paying cash dividends since they were initiated in the fiscal 2016 second quarter. About RCI Hospitality Holdings, Inc. (N.

New StreamSaver bundle saves customers more than 30% per month Add Sportsnet+ to stream and save even more

Rogers Communication (RCI) reported earnings 30 days ago. What's next for the stock?

Rogers will continue to sell connectivity and data centre services into the facilities Proceeds will be used to pay down debt TORONTO, Aug. 14, 2025 (GLOBE NEWSWIRE) -- Rogers Communications Inc. (TSX: RCI.A and RCI.B; NYSE: RCI) today announced it has entered into a definitive agreement with InfraRed Capital Partners to sell its portfolio of nine Rogers Business data centres. Rogers will continue to sell data centre services on behalf of InfraRed and will provide network connectivity to the data centres.

HOUSTON--(BUSINESS WIRE)--RCI Hospitality Holdings, Inc. (Nasdaq: RICK) today reported results for the fiscal 2025 third quarter ended June 30, 2025. The Company also filed its Form 10-Q today. Summary Financials (in millions, except EPS) 3Q25 3Q24 9M25 9M24 Total revenues $71.1 $76.2 $208.5 $222.4 EPS $0.46 $(0.56) $1.84 $0.30 Non-GAAP EPS1 $0.77 $1.35 $2.23 $3.11 Impairments and other charges, net $2.3 $18.3 $2.2 $26.5 Net cash provided by operating activities $13.8 $15.8 $35.7 $40.2 Free cas.

HOUSTON--(BUSINESS WIRE)--RCI Hospitality Holdings, Inc. (Nasdaq: RICK) plans to file its 10-Q and report financial results for the fiscal 2025 third quarter ended June 30, 2025 after the market closes on Monday, August 11. The Company will hold a related conference call on X Spaces at 4:30 PM ET. X Spaces Call & Presentation Hosted by RCI President and CEO Eric Langan, CFO Bradley Chhay, and Mark Moran of Equity Animal Call link: https://x.com/i/spaces/1OdJrDOQobXKX (X log in required) Pre.

Rogers' stock has surged recently on improved margins, stable revenue, low tariff exposure, and a favourable valuation, all supporting a continued bullish view. Wireless and cable segments are showing margin growth despite revenue headwinds, while user growth remains stable even as ARPU comes under competitive pressure. Future growth will rely on ARPU recovery and subscriber expansion, with bundling strategies and network quality supporting long-term top-line and margin improvements.