RGLD Stock Recent News

RGLD LATEST HEADLINES

Royal Gold, Inc. (NASDAQ:RGLD ) Q2 2025 Earnings Conference Call August 7, 2025 12:00 PM ET Company Participants Alistair Baker - Senior Vice President of Investor Relations & Business Development of Royal Gold Corp. Martin Raffield - Senior Vice President of Operations Paul K. Libner - Senior VP & CFO William H.

RGLD posts record Q2 revenues of $209M and a 45% EPS jump, driven by higher metal prices and strong gold output.

DENVER--(BUSINESS WIRE)--Royal Gold Reports Record Revenue, Operating Cash Flow and Earnings for the Second Quarter of 2025.

Canadian miner First Quantum Minerals signed a $1 billion gold streaming agreement with a subsidiary of its peer Royal Gold , the two companies said in a statement on Tuesday.

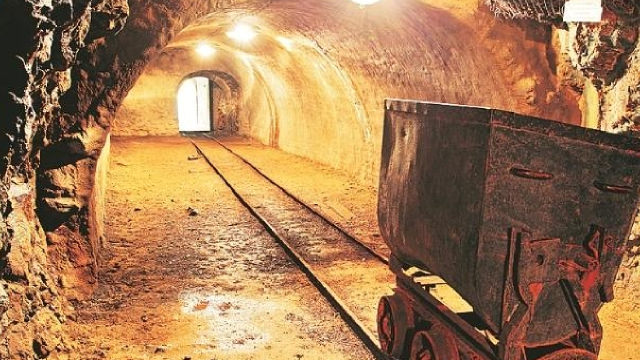

DENVER--(BUSINESS WIRE)--Royal Gold Acquires Gold Stream on the Large-Scale, Long-Life, Kansanshi Copper-Gold Mine Operated by First Quantum Minerals Ltd.

Investors interested in stocks from the Mining - Gold sector have probably already heard of Newmont Corporation (NEM) and Royal Gold (RGLD). But which of these two stocks is more attractive to value investors?

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Royal Gold (RGLD) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Royal Gold (RGLD) has become technically an oversold stock now, which implies exhaustion of the heavy selling pressure on it. This, combined with strong agreement among Wall Street analysts in revising earnings estimates higher, indicates a potential trend reversal for the stock in the near term.