RIO Stock Recent News

RIO LATEST HEADLINES

Glencore's long-term strategy of owning commodity assets and trading expertise makes it a unique and undervalued player in the mining sector. Despite recent volatility and bearish trends, scale-down buying of GLNCY shares could be optimal, especially with the potential for higher commodity prices ahead. Restructuring and asset shifts suggest Glencore is positioning itself for a mega-merger, which could unlock significant shareholder value.

I use YCharts' Value Score and Ben Graham Formula Value All Stars, or GASV, to identify large-cap stocks offering strong value and dividend safety. Seventeen out of twenty-four "safer" lowest-priced Dividend Dogs of the GASV are currently fair-priced and ready to buy for income investors. Top ten GASV stocks offer projected average net gains of 32.99% by June 2026, with yields ranging from 8.94% to 13.81%.

RIO commits $800M to the Hope Downs 2 project in Pilbara, targeting 31Mtpa output and 1,000 long-term jobs by 2027.

MISSISSAUGA, ON , June 24, 2025 /PRNewswire/ - Cymat Technologies Ltd. (TSXV: CYM) (OTCQB: CYMHF) (the "Company" or "Cymat") is pleased to announce that it has entered into a Letter of Intent ("LOI") with Rio Tinto Alcan Inc. ("RTA") to acquire the technology and related knowhow to manufacture its proprietary aluminum metal matrix composites ("MMC") and to facilitate the transfer of RTA's customers for the product.

Australia's Rio Tinto , and Hancock Prospecting will invest $1.61 billion to develop the Hope Downs 2 iron ore project in Western Australia's Pilbara region, Rio Tinto said on Tuesday.

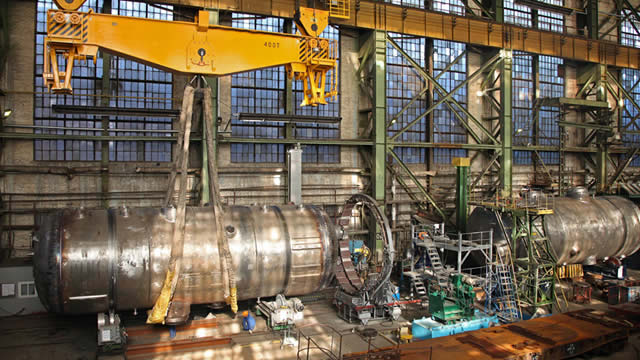

PERTH, Australia--(BUSINESS WIRE)--Rio Tinto and Hancock Prospecting will invest $1.61 billion (Rio Tinto share $0.8 billion) to develop the Hope Downs 2 iron ore project in Western Australia's Pilbara region. The Hope Downs 2 project, to mine Rio Tinto and Hancock Prospecting's Hope Downs 2 and Bedded Hilltop deposits, has now received all necessary State and Federal Government approvals. The two new above-water-table iron ore pits will have a combined total annual production capacity of 31 mi.

Rio Tinto agreed to pay $138.75 million to resolve a class-action lawsuit that alleged the company concealed problems during the expansion of a giant copper mine in Mongolia.

Rio Tinto , agreed to pay $138.75 million to settle a lawsuit accusing the Anglo-Australian mining giant of defrauding investors by failing to disclose problems with its $7 billion underground expansion of the Oyu Tolgoi copper and gold mine in Mongolia, according to court records.

RIO's NeoSmelt venture wins ARENA backing for a pilot plant aiming to slash steelmaking emissions by up to 80%.

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?