RIVN Stock Recent News

RIVN LATEST HEADLINES

The EV market is expected to grow at a compound annual growth rate (CAGR) of 32% through 2030, but Rivian Automotive Inc.

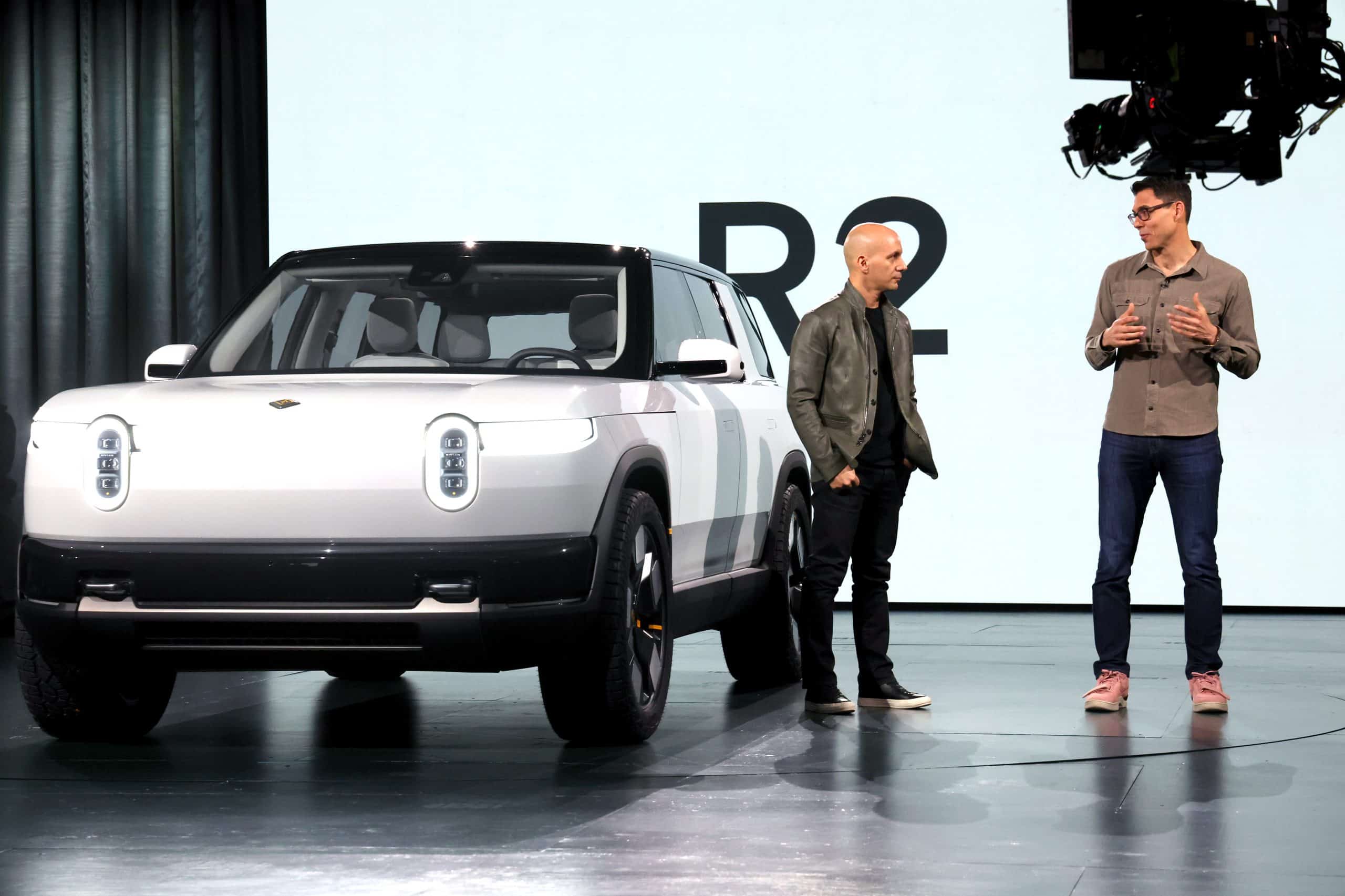

Rivian Automotive, Inc. (NASDAQ:RIVN ) TD Cowen 9th Annual Future of the Consumer Conference June 3, 2025 3:30 PM ET Company Participants RJ Scaringe - Founder & CEO Conference Call Participants Itay Michaeli - TD Cowen Itay Michaeli I'm Itay Michaeli, TD Cowen's Auto Mobility Analyst. And I'm delighted to have with us today Rivian's Founder and CEO, RJ Scaringe, for a fireside chat.

Key growth drivers include cost reduction in EV components and increased production capacity, targeting profitability by 2027. Rivian aims to cut material costs by 45% with the introduction of its Gen 2 platform by 2026.

IRVINE, Calif.--(BUSINESS WIRE)--Rivian Automotive, Inc. (Nasdaq: RIVN) (“Rivian”) today announced that Rivian Holdings, LLC (the “Company”), Rivian, LLC (“Rivian LLC”) and Rivian Automotive, LLC (“Rivian Automotive” and, together with the Company and Rivian LLC, the “Co-Issuers”) intend to offer, subject to market and other customary conditions, $1,250,000,000 aggregate principal amount of senior secured green notes due 2031 (the “notes”) in a private offering. Rivian expects to use the net pr.

Rivian Automotive (RIVN -2.90%) investors have been very happy over the past month. The valuation of this electric car stock has surged by roughly 40%.

Rivian Automotive is working with JPMorgan Chase on a potential high-yield bond sale, in part to refinance its upcoming debt, Bloomberg News reported on Friday, citing people familiar with the transaction.

Market Domination anchor Josh Lipton breaks down the latest market trends for May 29, 2025. US stocks closed higher as investors weigh Nvidia earnings and tariff uncertainty.

Rivian Automotive (RIVN) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

After a weekend marked by Warren Buffett officially announcing his departure from Berkshire Hathaway, investors are reminded of the importance of disciplined, fundamentals-based investing. Now, perhaps more than ever, investors need to be diligent in an increasingly speculative market.

Shares of Rivian Automotive Inc. (NASDAQ: RIVN) have retreated 9.1% over the past five trading sessions, reducing the stock’s year-to-date gain to 15.6%. After the recent first-quarter earnings report and downbeat guidance, some Wall Street analysts continue to downgrade the stock or decrease their price targets. Rivian, a prominent electric vehicle (EV) manufacturer, is striving to regain momentum after its first-quarter earnings report on May 6. Despite surpassing Wall Street’s expectations with adjusted losses of $0.48 per share versus analyst expectations of $0.92 per share, and posting revenue of $1.24 billion compared to the $1.01 billion forecast, the stock fell almost 6% the next day, closing at $12.72 per share. This reflected a year-to-date loss of 4% and a 90% decline from its November 2021 IPO high. 24/7 Wall St. Key Points: The EV market is expected to grow at a compound annual growth rate (CAGR) of 32% through 2030, but Rivian Automotive Inc. (NASDAQ: RIVN) foreca