RKLB Stock Recent News

RKLB LATEST HEADLINES

Rocket Lab was founded in 2006 by CEO Peter Beck and went public via SPAC in 2021. Initially known for its small satellite launch capabilities via its Electron rocket, the company has since expanded into spacecraft manufacturing, satellite components, and now satellite payloads.

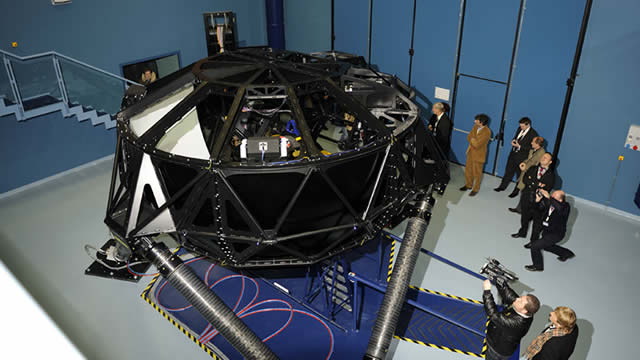

LONG BEACH, Calif.--(BUSINESS WIRE)---- $RKLB--Rocket Lab Corporation (Nasdaq: RKLB) (“Rocket Lab” or “the Company”), a global leader in launch services and space systems, today announced it has awarded a contract to Bollinger Shipyards, the largest privately owned new construction and repair shipbuilder in the United States, to support the build out of Rocket Lab's ocean landing platform for its Neutron reusable rocket. Modification and fit-out of Rocket Lab technology to its 400-ft-long landing platfor.

Key Points in This Article: The Magnificent 7 transformed markets through AI and digital ecosystems, turning a once-pejorative label into a celebrated symbol of innovation and growth.

Growth stocks have made a strong comeback after a rocky start to the year, driven by anticipated deregulation and significant breakthroughs in artificial intelligence (AI). Valuations have surged, and at first glance, bargains seem extinct.

Aided by bullish momentum for the broader market, Rocket Lab (RKLB -0.36%) stock posted big gains in June's trading. The company's share price rocketed 33.5% higher in the month, according to data from S&P Global Market Intelligence.

When picking new stocks for your portfolio, your best bet is looking for companies that you can hold forever. It may take that long for an idea or a business premise to fully pay off!

Shares of Rocket Lab Corp. ended Monday's session up 9% amid the ongoing clash between President Donald Trump and SpaceX Chief Executive Elon Musk.

Live Updates Live Coverage Updates appear automatically as they are published. Bottom Falls Out 12:48 pm by Gerelyn Terzo The bottom has fallen out of the stock market once again after President Trump revealed whopping 25% tariffs on Japan and South Korea imports, beginning on Aug. 1. These tariffs are on top of existing sector-specific levies that have already been set into motion. Over the weekend, President Trump began ramping up his tariff talk involving BRIC nation policies, saying, “Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy.” The Nasdaq Composite is now falling 0.91% on the day. AI Consolidation 11:17 am by Gerelyn Terzo Consolidation is afoot in the AI industry. In today’s Merger Monday, AI company CoreWeave announced it will acquire Core Scientific in a blockbuster $9 billion stock deal. The target company builds data center infrastructure built

Rocket Lab Corp. RKLB joined the Russell 1000, and NASA announced a major streaming partnership last week. Here's a look at recent highlights, news catalysts, and upcoming events in the space stock sector.

Rocket Lab's Q1-FY25 revenue hit $122.6 million, up 32.1% YoY, driven by strong Space Systems performance. Neutron rocket development targets 13-ton payloads with a $50–55 million ASP, competing directly with SpaceX's Falcon 9. Vertical integration boosts gross margin to 28.8% GAAP and 33.4% non-GAAP, exceeding management's guided ranges.