SCCO Stock Recent News

SCCO LATEST HEADLINES

The Global X Copper Miners ETF offers diversified exposure to global copper mining equities, which tracks the Solactive Global Copper Miners Total Return Index. COPX's performance is highly correlated with copper prices, which are heavily influenced by Chinese industrial demand and global economic trends. COPX is the largest and most liquid copper miners ETF, with a 1.51% yield and a 0.65% expense ratio.

The latest trading day saw Southern Copper (SCCO) settling at $99.91, representing a -3.37% change from its previous close.

5 Relatively Secure And Cheap Dividend Stocks, Yields Up To 9% (Sept. 2025)

Despite the Zacks Mining-Non Ferrous industry's weak near-term outlook, stocks like SCCO, FCX, FQVLF, CDE and LEU are worth keeping an eye on.

Southern Copper (SCCO) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Investors need to pay close attention to SCCO stock based on the movements in the options market lately.

Southern Copper (SCCO) concluded the recent trading session at $97.11, signifying a -1.1% move from its prior day's close.

Subscribers to Chart of the Week received this commentary on Sunday, July 13.

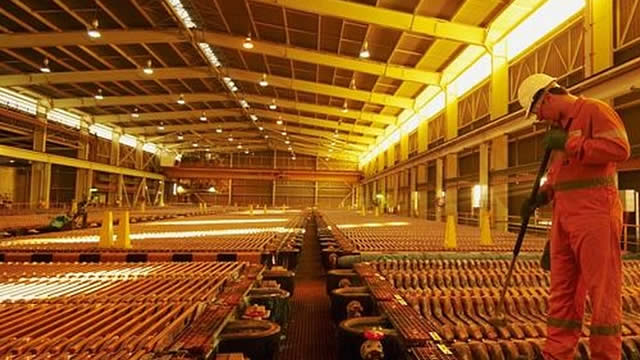

A shift to more domestic production could take years. Copper prices and mining stocks are rising.