SCHW Stock Recent News

SCHW LATEST HEADLINES

3M and Chas Schwab shares are up this morning on solid Q2 beats, while Housing Starts and Building Permits data improves.

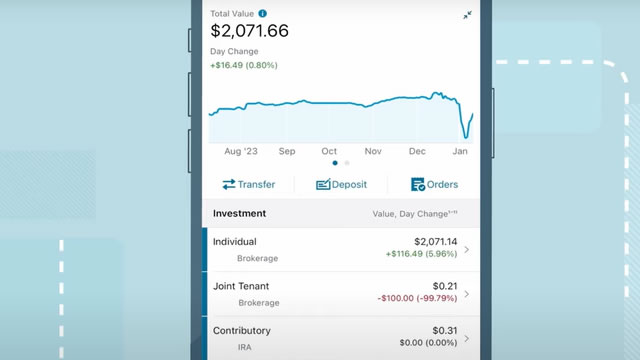

Bank stock Charles Schwab Corp (NYSE:SCHW) is trading at record highs this morning, up 4.6% at $97.50 at last glance, after the company's better-than-expected second-quarter results.

SCHW shares rise on Q2 earnings beat, fueled by strong trading, asset management and record $10.76T client assets.

The headline numbers for Charles Schwab (SCHW) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

The Charles Schwab Corporation (SCHW) came out with quarterly earnings of $1.14 per share, beating the Zacks Consensus Estimate of $1.09 per share. This compares to earnings of $0.73 per share a year ago.

U.S. brokerage firm Charles Schwab said on Friday its profit rose nearly 60% in the second quarter, driven by robust trading activity and increased asset management fees.

Charles Schwab's stock briefly sees record territory after an earnings beat.

The brokerage benefited from the market's busy—and bumpy—ride since April.

WESTLAKE, Texas--(BUSINESS WIRE)--The Charles Schwab Corporation reported second quarter core net new assets equal $80.3 billion, up 31% year-over-year.

The Charles Schwab Corporation SCHW will release earnings results for the second quarter, before the opening bell on Friday, July 18.