SENEB Stock Recent News

SENEB LATEST HEADLINES

FAIRPORT, N.Y., June 12, 2025 (GLOBE NEWSWIRE) -- Seneca Foods Corporation (NASDAQ: SENEA, SENEB) today announced financial results for the fourth quarter and twelve months ended March 31, 2025.

Seneca Foods is a value play in the packaged produce sector, trading at low multiples due to recent volatility and lumpy financial performance. Revenue and profitability are highly sensitive to commodity price swings, particularly corn and green beans, making results unpredictable year-to-year. While financial results remain mixed and lack stability, the stock is attractively cheap relative to peers, justifying a soft 'buy' rating for value investors.

FAIRPORT, N.Y., Feb. 06, 2025 (GLOBE NEWSWIRE) -- Seneca Foods Corporation (NASDAQ: SENEA, SENEB) today announced financial results for the third quarter and nine months ended December 28, 2024.

FAIRPORT, N.Y., Nov. 06, 2024 (GLOBE NEWSWIRE) -- Seneca Foods Corporation (NASDAQ: SENEA, SENEB) today announced financial results for the second quarter and six months ended September 28, 2024.

FAIRPORT, N.Y., Aug. 08, 2024 (GLOBE NEWSWIRE) -- Seneca Foods Corporation (NASDAQ: SENEA, SENEB) today announced financial results for the three months ended June 29, 2024.

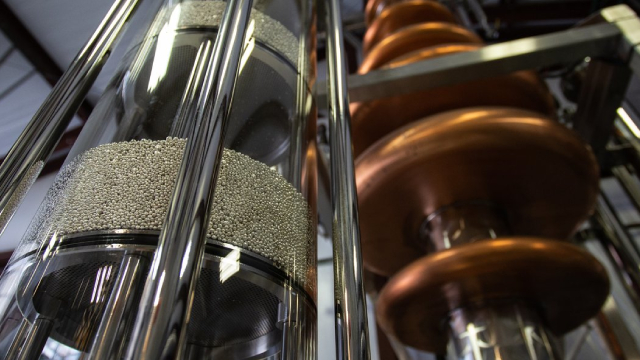

Our portfolio is largely unchanged from last quarter, with Net Lease Office Properties still at the top. McBride shares have performed well for us, up about 30% from the level of our initial purchases. Talen will continue to sell off its legacy fossil fuel-burning power generation fleet and return excess capital to shareholders through buybacks.

The company's net loss shrank to $2.2 million for Q4 FY24 from $33.1 million a year earlier despite weaker sales. However, if we use the internationally dominant FIFO inventory valuation method, EBITDA declined by 22.7% to $23.1 million. While Seneca Foods doesn't look expensive at 0.7x price to tangible book value, I'm concerned about the rising net debt level.

FAIRPORT, N.Y., June 13, 2024 (GLOBE NEWSWIRE) -- Seneca Foods Corporation (NASDAQ: SENEA, SENEB) today announced financial results for the fourth quarter and twelve months ended March 31, 2024.

The SENEA investment narrative has shifted to focus on its earnings power rather than its balance sheet value. However, over the next 12–18 months, I think the stock will largely be driven by Seneca's sales volume. Based on commentary from Del Monte Pacific and anecdotal evidence, I see a compelling case to be made that sales volume will stabilize into FY2025.

FAIRPORT, N.Y., Feb. 08, 2024 (GLOBE NEWSWIRE) -- Seneca Foods Corporation (NASDAQ: SENEA, SENEB) today announced financial results for the third quarter and nine months ended December 30, 2023.