SLB Stock Recent News

SLB LATEST HEADLINES

Schlumberger (SLB) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Founded in 1869, Goldman Sachs is the world's second-largest investment bank by revenue and is ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue.

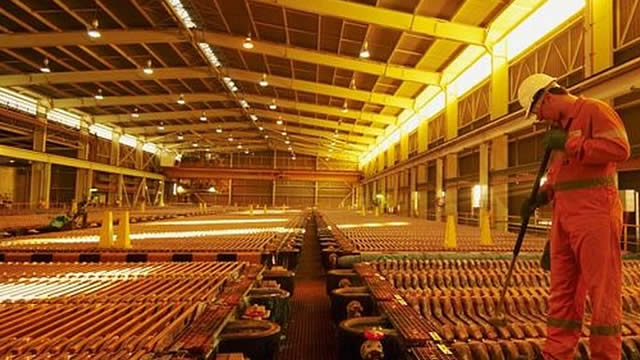

I reiterate my buy rating on Schlumberger with a $40.80 price target, citing relative undervaluation versus peers despite macro uncertainty. The ChampionX acquisition expands SLB's US presence in chemicals and digital capabilities, offering synergy potential and positioning for enhanced oil recovery trends. Segment performance is mixed, with Well Construction and Reservoir Performance lagging, but Digital & Integration and Production Systems supporting growth.

The Dividend Harvesting Portfolio rebounded strongly, with profitability up 8.06% and total dividend income now at 19.77% of invested capital. I remain bullish on the S&P 500 reaching 7,000 this year, driven by strong corporate earnings, AI productivity, and a likely lower rate environment. Recent additions to the portfolio—BMY, SLB, and AGNC—reflect my focus on undervalued, high-yield opportunities poised to benefit from rate cuts.

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

SLB generates ample cash flow even at what appears to be the cyclical low for energy services. The shareholder returns cover the downside while waiting for the cycle to turn around. The ChampionX acquisition, which finally closed, could be a positive catalyst due to synergies and the stable earnings profile of the acquired business.

Schlumberger (SLB) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Recently, Zacks.com users have been paying close attention to Schlumberger (SLB). This makes it worthwhile to examine what the stock has in store.

The final trades of the day with CNBC's Melissa Lee and the Fast Money traders.