SMCI Stock Recent News

SMCI LATEST HEADLINES

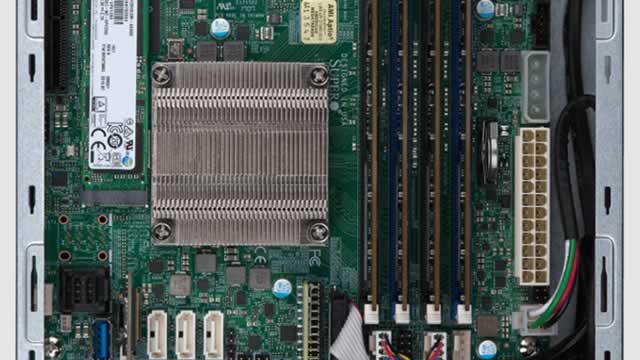

Super Micro Computer Inc. (NASDAQ: SMCI) stock has its bullish supporters, some of whom feel it can withstand global trade issues and that it may be one of the best artificial intelligence (AI) stocks this year.

Super Micro (SMCI) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Despite weak Q3 results and slowing revenue growth, I maintain my buy rating on SMCI due to its strong long-term AI positioning. The company resolved its accounting investigation, avoided delisting, and is strengthening governance, reducing a major overhang on the stock. Short-term guidance remains weak, but robust cash flow is promising and AI product leadership suggests future growth potential.

The latest round of tariff implementations from the United States has landed on metals, this time centered on copper. As a reaction to a 50% tariff on copper trade with the United States, the open market price of the metal shot up by over 10% in a single day.

VRT and SMCI race to lead AI-driven liquid cooling, but diverging earnings paths may reveal the stronger play.

Super Micro is poised for rapid sales and profit growth, fueled by surging data center demand and a $20B DataVolt deal. The stock's high short interest (18%) creates significant short squeeze potential, especially if upcoming earnings exceed expectations. Super Micro is undervalued versus AI and server peers, with a 46% upside if re-rated to a 25x forward P/E multiple.

While Super Micro Computer (NASDAQ: SMCI) has experienced an impressive run this year, surging 67.59% to close at $50.36 in the last trading session, Wall Street analysts remain cautious about the company's near-term prospects.

Supermicro is a buy for investors willing to speculate, as it overcomes past accounting issues and capitalizes on robust AI infrastructure demand from hyperscalers and enterprises. Despite a Q3 revenue miss due to delayed AI platform adoption, AI GPU solutions still drive over 70% of revenues, signaling strong market appeal. Upcoming quarters should benefit from Nvidia ramping up shipments of new Blackwell GPUs, supporting future topline growth.

BofA Securities has resumed coverage on Super Micro Computer (NASDAQ: SMCI) with an ‘Underperform' rating and set a $35 price target, representing roughly 28.5% downside from current levels.

Super Micro Computer's stock surged nearly 70% since April, fueled by AI enthusiasm and easing trade tensions, despite recent earnings misses and margin compression. Recent quarters showed strong year-over-year revenue growth but declining profit margins and EPS, mainly due to inventory issues and delayed customer orders. Upside potential remains due to AI demand, new product launches, and insider ownership, though insider selling and inventory risks warrant caution.