SMCI Stock Recent News

SMCI LATEST HEADLINES

Super Micro Computer Inc SMCI is trading in the shadows of Nvidia Corp's NVDA blockbuster earnings event, but investors are asking if this week could finally snap it out of its slump.

Super Micro Computer targets $33B revenues in FY26, banking on AI demand and data center solutions to fuel growth momentum.

Speculation and news headlines aside, there is a pretty simple way for investors to know whether a stock has priced in its future growth yet or not, creating a reliable manner to measure whether they should stay invested in a company through the hard times or whether it is time to liquidate and go hunting for the next best deal. This can all be done with a single ratio.

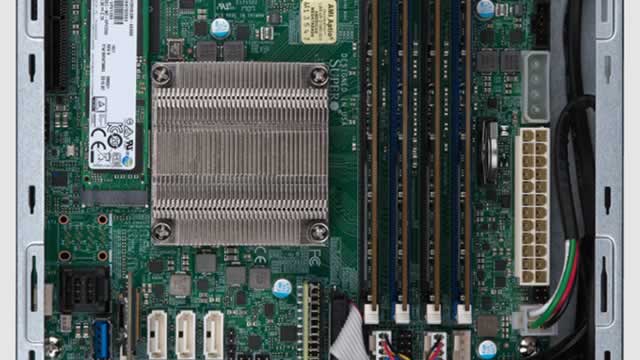

Expanded AI infrastructure with faster results with Supermicro's GPU-optimized servers Large-scale AI factories for training and inference deployed in record time Supermicro's advanced liquid-cooling reduces power and cooling costs, enabling energy efficiency and sustainability SAN JOSE, Calif. , Aug. 25, 2025 /PRNewswire/ -- Super Micro Computer, Inc. (SMCI), a Total IT Solution Provider for AI/ML, HPC, Cloud, Storage, and 5G/Edge, announced today that Lambda, the Superintelligence Cloud, has deployed a broad portfolio of Supermicro GPU-optimized servers including NVIDIA Blackwell based systems to expand its AI infrastructure and deliver high-performance systems to its customers.

The three tech stocks in this market analysis look forward to the speech by Jerome Powell, to get an idea of what the Federal Reserve is going to do with its monetary policy. This area of the stock market is very sensitive to this, so it makes sense that we

I'm upgrading Super Micro Computer to a "Buy" with a $74.89 price target, driven by the launch of its Data Center Building Block Solutions (DCBBS). DCBBS is expected to boost margins and diversify SMCI's customer mix toward higher-margin enterprise AI infrastructure solutions. Despite revenue growth headwinds and inventory build, SMCI's strong balance sheet and capital raise position it well for future growth.

Super Micro Computer meets most criteria to be qualified as a "Value Play" according to Peter Lynch's principles of value investing. However, there is more to the story than mere financial metrics. Despite growth and AI tailwinds, I think Super Micro lacks a durable competitive moat compared to GPU leaders and integrated IT giants. Dell is growing almost double SMCI and is cheaper. Current valuation appears attractive, but competitive pressures and weak recent growth make a long-term BUY recommendation premature.

I'm neutral on Super Micro Computer due to recent revenue shortfalls, cautious guidance, and deteriorating sentiment reflected in the stock's price action. Gross margins have been sliding since late 2022, and Q1 FY26 is only expected to match Q4 FY25. The situation may improve in the back half of FY2026. I believe customers are waiting for Nvidia's GB300. In fact, the Street is projecting a recovery in growth and EPS (again, backweighted to the second half of FY2026).

New DLC-2 4U Front I/O liquid-cooled system provides up to 40% data center power savings 8U front I/O air-cooled system delivers enhanced system memory configuration flexibility, density, and cold aisle serviceability The new front I/O air-cooled or liquid-cooled configurations expand customer choice and serve broader AI Factory environments SAN JOSE, Calif. , Aug. 11, 2025 /PRNewswire/ -- Supermicro, Inc. (NASDAQ: SMCI), a Total IT Solution Provider for AI, HPC, Cloud, Storage, and 5G/Edge, today announced the expansion of its NVIDIA Blackwell system portfolio with the new 4U DLC-2 liquid-cooled NVIDIA HGX B200 system ready for volume shipment and the introduction of an air-cooled 8U front I/O system.

Super Micro Computer, Inc. SMCI is trading flat on Tuesday. This comes after yesterday's selloff of more than 18%.