SPXC Stock Recent News

SPXC LATEST HEADLINES

SPX Technologies, Inc (NYSE:SPXC ) Q4 2024 Earnings Call Transcript February 25, 2025 4:45 PM ET Company Participants Paul Clegg - Vice President, Investor Relations Gene Lowe - President and Chief Executive Officer Mark Carano - Vice President, Chief Financial Officer and Treasurer Conference Call Participants Bryan Blair - Oppenheimer Damian Karas - UBS Ross Sparenblek - William Blair Steve Ferazani - Sidoti Brad Hewitt - Wolfe Research Operator Good day, and thank you for standing by. Welcome to the Fourth Quarter 2024 SPX Technologies Earnings Conference Call.

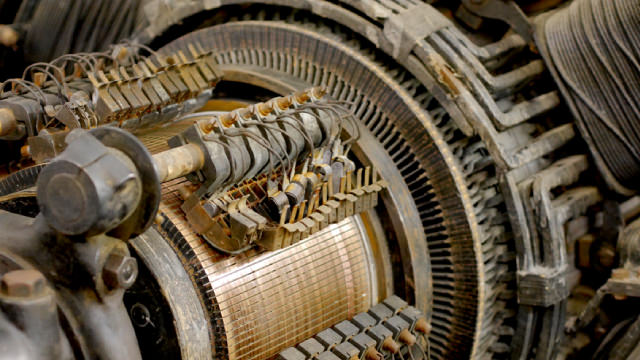

CHARLOTTE, N.C., Feb. 25, 2025 (GLOBE NEWSWIRE) -- SPX Technologies Inc. (NYSE:SPXC) will host a tour of its Ingénia Technologies production facility on April 1, 2025, in Mirabel, Quebec, near Montreal. The event will be hosted by SPX's corporate Investor Relations team and key managers of the company's HVAC segment. The event is expected to begin mid-day and last approximately two hours in total. It will be open to current and prospective investors of SPX, as well as interested sell-side analysts.

While the top- and bottom-line numbers for SPX Technologies (SPXC) give a sense of how the business performed in the quarter ended December 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

SPX Technologies (SPXC) came out with quarterly earnings of $1.51 per share, beating the Zacks Consensus Estimate of $1.50 per share. This compares to earnings of $1.25 per share a year ago.

Q4 and Full Year 2024 GAAP EPS of $1.19 and $4.29 Compared with $0.67 and $3.10 in 2023, Up 78% and 38% Full-Year 2024 GAAP Net Income of $200.5 million Compared with $89.9 million in 2023, Up 123% Q4 and Full-Year Adjusted EPS* of $1.51 and $5.58 in 2024 Compared with $1.25 and $4.31 in 2023, Up 21% and 29% Introducing 2025 Full-Year Adjusted EPS* Guidance Range of $6.00-$6.25

As Bitcoin (/BTC) falls to 3-month lows, Kevin Green points to fundamental factors that are weighing on its price activity. He says the technical setup indicates possible selling pressure remains for popular crypto asset.

Evaluate the expected performance of SPX Technologies (SPXC) for the quarter ended December 2024, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

Kevin Green says Friday's trading session will close as the lowest-volume day so far in 2025. However, after the long weekend, potential catalysts can reignite trading quickly.

According to Kevin Green, bulls still have the edge despite the SPX still falling short of the 6,100 mark. He says "too much green" to start the trading day would raise warning signs.

Kevin Green points to bullish potential ending the trading week. He highlights this morning's open breaking through channels he's been watching all week.