SSNLF Stock Recent News

SSNLF LATEST HEADLINES

Petrofac Limited (LSE:PFC) has reached an agreement in principle regarding claims for the Thai Oil project from Samsung E&A and Saipem, which will allow it to complete its restructuring. The commercial terms proposed are supported by the 'Ad Hoc Group' of bondholders, subject to the agreement of long-form documents.

The US economy is showing signs of slowing, with the labor market cooling, consumer sentiment weak, Q3 GDP expected to slow to ~1.3%, and inflation still above the Fed's 2% target. Stagflation is now becoming a real risk. Markets are expensive; the S&P 500 is near all-time highs, and broad-market ETFs like VOO, QQQ, and VTI may only deliver modest returns over the next few years.

NEW YORK--(BUSINESS WIRE)--Cantor, a premier investment bank, and Samsung Securities Co., Ltd. (“Samsung Securities”), one of Korea's leading securities companies, today signed a Memorandum of Understanding to explore strategic business opportunities to work together across capital markets, brokerage, and financial strategies. The collaboration reflects a shared commitment to expand the firms' global reach and deliver innovative solutions for clients in areas such as securities trading, capital.

The U.S. is reportedly proposing a plan for Samsung Electronics Co. and SK Hynix to seek yearly approvals to export U.S. chip-making gear to China, allowing the South Korean tech giants to keep producing their chips.

The United States is proposing annual approvals for exports of chipmaking supplies to Samsung Electronics and SK Hynix's China-based factories, Bloomberg News reported on Monday.

BERLIN--(BUSINESS WIRE)--At Innovation For All (IFA) 2025, Samsung Electronics showcased its vision for “AI Home: Future Living, Now”. Samsung's AI Home aims to be a reality people can experience today — not just in the future — and one designed for everyone, not just a select few. “At Samsung, we're not just imagining the future of AI; we're building it into everyday life. Samsung's AI Home moves beyond smart devices to homes that truly understand you, adapt to your needs, and care for what ma.

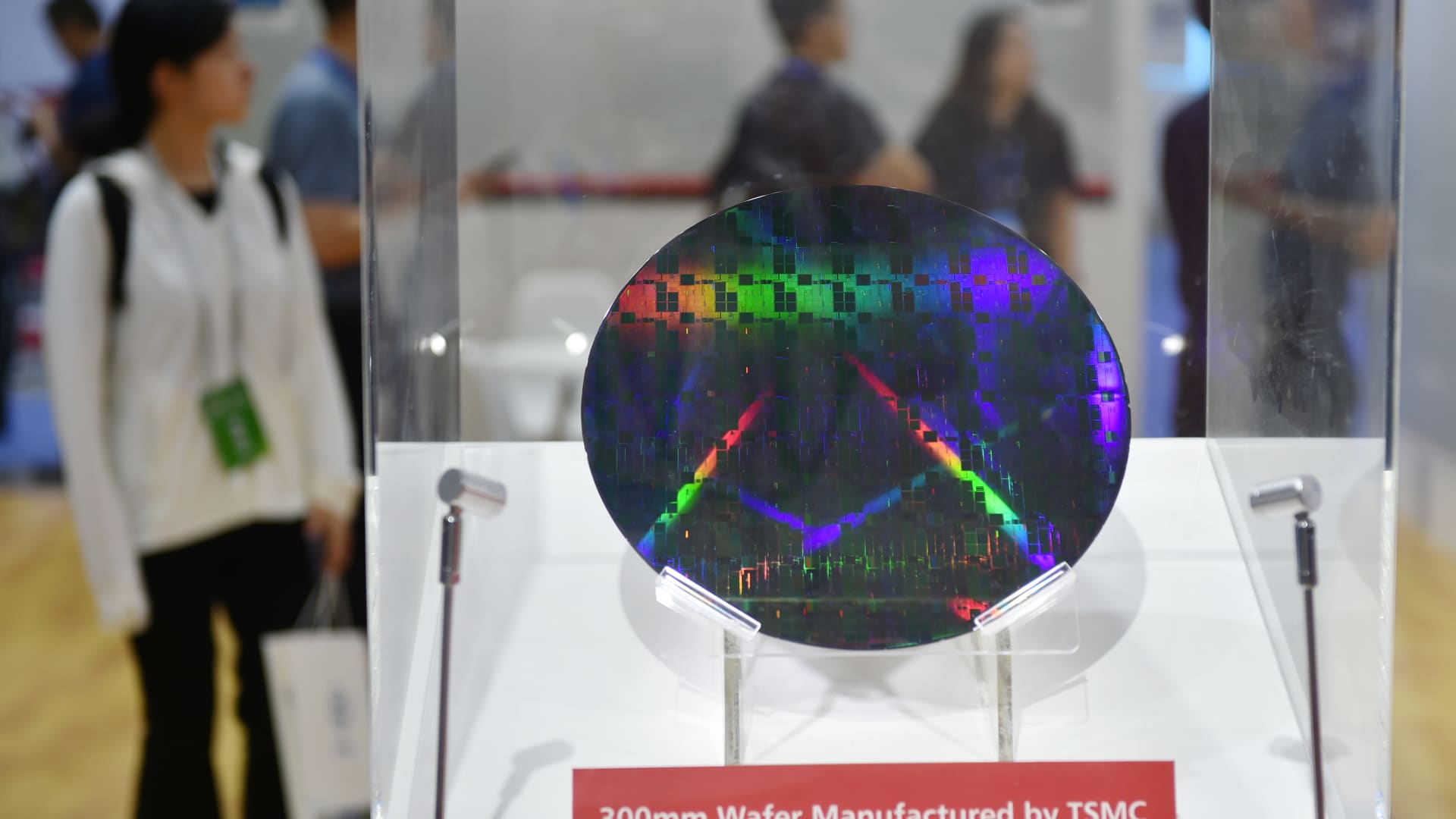

The change will remove a fast-track export privilege known as validated end user status, effective Dec. 31, TSMC confirmed to CNBC on Wednesday. South Korean memory chipmakers SK Hynix and Samsung Electronics are also losing export privileges, as the U.S. continues to shift its semiconductor trade policies with China.

A ruling in the U.S. search antitrust case against Alphabet's Google on Tuesday is a win for mobile phone manufacturers including Apple and Samsung , who a judge said Google can keep paying to be the default search engine on new devices.

SK Hynix and Samsung stocks dropped after U.S. Commerce Department said it would change the licensing system to obtain U.S. equipment for their Chinese plants.

Shares in Samsung Electronics and SK Hynix dropped on Monday after Washington revoked authorisations that allowed them to secure U.S. semiconductor manufacturing equipment for their chip plants in China.