ST Stock Recent News

ST LATEST HEADLINES

Sensata (ST) reported earnings 30 days ago. What's next for the stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

After losing some value lately, a hammer chart pattern has been formed for Sensata (ST), indicating that the stock has found support. This, combined with an upward trend in earnings estimate revisions, could lead to a trend reversal for the stock in the near term.

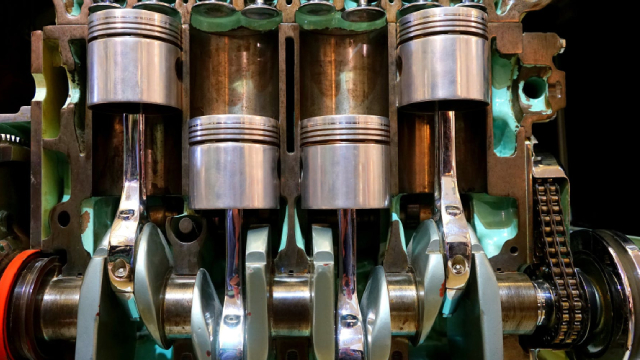

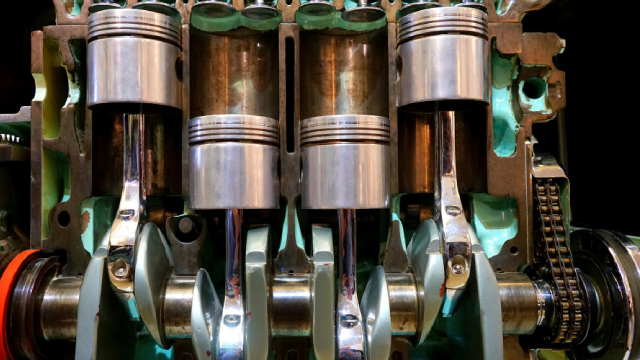

ST's Q2 revenues fall 8.9% but top forecasts, as growth in Sensing Solutions helps soften weakness in Performance Sensing.

Sensata Technologies Holding PLC (NYSE:ST ) Q2 2025 Earnings Conference Call July 29, 2025 5:00 PM ET Company Participants R - Corporate Participant a - Corporate Participant h - Corporate Participant e - Corporate Participant Andrew Charles Lynch - CFO & Executive VP James Entwistle - Corporate Participant Stephan Von Schuckmann - CEO & Director Conference Call Participants Christopher D. Glynn - Oppenheimer & Co. Inc., Research Division Joseph Craig Giordano - TD Cowen, Research Division Joseph Robert Spak - UBS Investment Bank, Research Division Konstandinos Evangelos Tasoulis - Wells Fargo Securities, LLC, Research Division Luke L.

The headline numbers for Sensata (ST) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Sensata (ST) came out with quarterly earnings of $0.87 per share, beating the Zacks Consensus Estimate of $0.84 per share. This compares to earnings of $0.93 per share a year ago.

The increasing adoption of industrial automation, focus on higher energy efficiency and optimum resource utilization should drive the Zacks Instruments - Control industry. WTS, ST and THR are well-positioned to gain from the evolving market dynamics.