SWBI Stock Recent News

SWBI LATEST HEADLINES

Stocks trading at or near their 52-week lows offer value and higher-than-average yields that investors can capitalize on. The risk is that stock trading at or near their 52-week lows also often move on to set lower lows, undermining the opportunity.

Key Points The US Navy SEALs are among the most elite Special Forces units in the world Their choice in weapons reflects their expertise in the field as well as their versatility SEALs use anything from sniper rifles, side arms, shotguns, and everything in between Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor) The US Navy SEALs are among the most elite Special Forces units in the world, and it comes as no surprise that their choice of firearms reflects their expertise in the field. These soldiers choose their weapons based on operational need and flexibility, with an incredible arsenal to choose from. In their operations SEALs use anything from sniper rifles, side arms, shotguns, and everything in between. Here, 24/7 Wall St. is taking a

Americans have varied reasons for gun ownership. These reasons include hunting, protection, sport shooting, and collecting. Some owners need them for their jobs; law enforcement and soldiers keep a side arm and usually some type of shotgun. A 2023 Gallup survey stated that 42% of Americans personally own a firearm. There are approximately 120.5 guns to 100 people in the US. Whatever the reasoning behind owning a gun – firearm sales are booming. It’s important to note that gun ownership rates vary significantly among diverse demographic groups, regions, income brackets, and other categorizations. Geographic region dictates a notable difference in ownership rates. In the Eastern US, approximately 19% own firearms. On the other hand, the Southern states have reached about 40%, over twice as high. 24/7 Wall St. reviewed the most recent Gallup poll, Household Gun Ownership in the U.S. Among Subgroups. The survey questioned whether respondents possessed firearms individually. Par

Shares of Smith & Wesson Inc. NASDAQ: SWBI are down 12% after the company reported its fourth quarter earnings for fiscal year 2025 after the market closed on June 18. The firearms manufacturer reported $140.76 million in revenue in the quarter.

Shares of Smith & Wesson declined after the company posted lower profit and revenue in its latest quarter and said it expects softer demand for firearms to continue.

The gun manufacturer's sales plummeted roughly 50% between its 2021 and 2023 fiscal years, and they have flatlined since.

U.S. stock futures were lower this morning, with the Dow futures falling around 0.2% on Friday.

Downgrading Smith & Wesson due to disappointing free cash flow and weak FY25 results, missing revenue and earnings estimates. Rising inventory, declining cash reserves, and increased debt signal potential financial strain and risk to future dividends and buybacks. The current valuation is too high given the lack of near-term growth, ongoing macroeconomic pressures, and execution challenges.

The United States is the largest consumer market for firearms in the world, and that market is largely dominated by pistols. Pistols — a specific category of handguns that excludes revolvers — accounted for over 40% of all domestic firearm manufacturing in the U.S. in 2023. For context, rifles (the second most popular firearm type) accounted for less than 32%. 24/7 Wall St. Key Points: In recent decades, American law enforcement and the U.S. military have moved away from large-caliber sidearms in favor of 9mm pistols. Still, 9mm handguns are not well suited for many common firearm applications, and consumer demand for many larger caliber pistols remains strong — particularly bearing the name of certain gunmakers. Also: Discover the next Nvidia In recent decades, pistols chambered for 9mm ammunition have emerged as a clear favorite among American gun owners. Smaller than some other pistol calibers, 9mm firearms generally benefit from reduced recoil, greater magazine ca

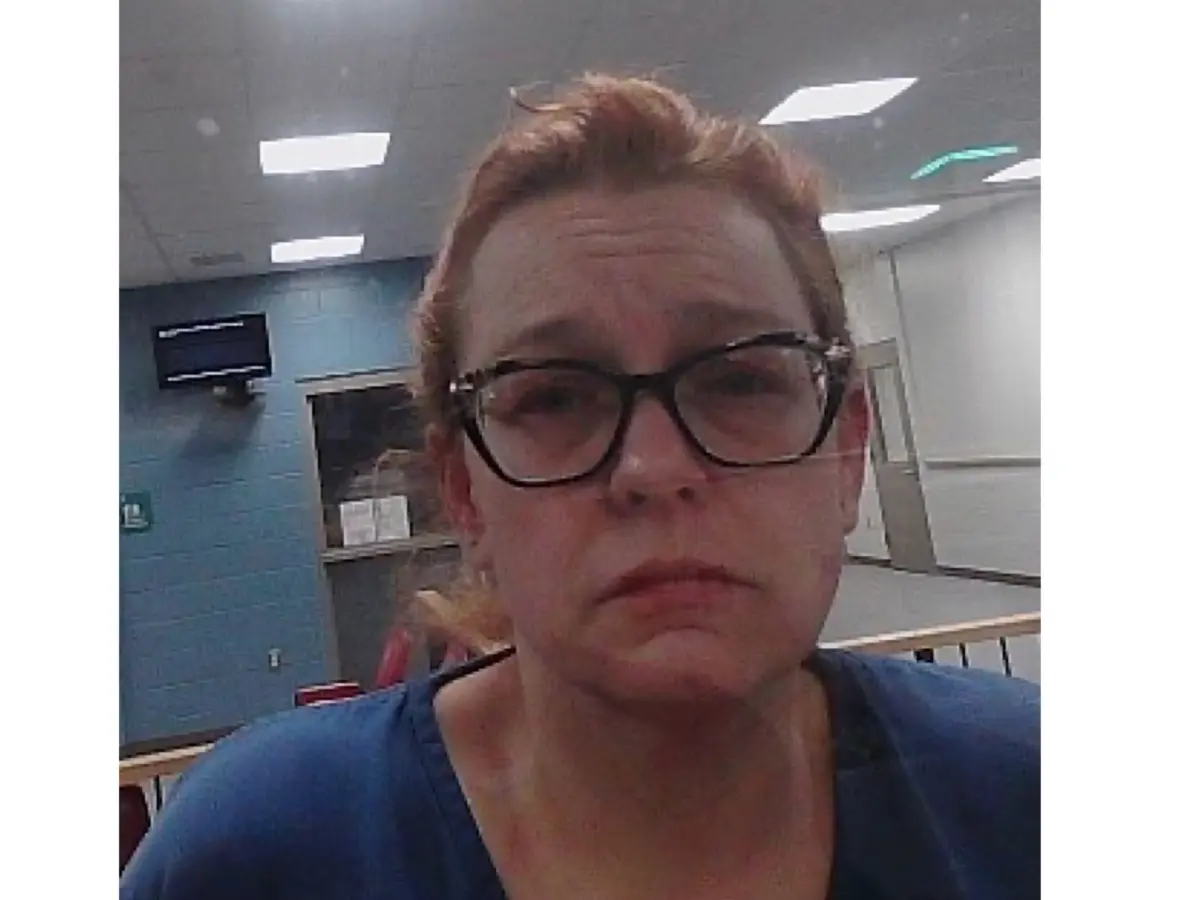

HENNIKER, NH — A woman from Concord was arrested last month and held without bail after being accused of firing a gun at Henniker police officers during a welfare check call. Erica Kowalski, 48, of Hampshire Drive in Concord, was arrested on May 30, 2025, on reckless conduct-deadly weapon and criminal threatening-deadly weapon, both felonies, as well as negligent discharge-gun, bow, etc., simple assault, two resisting arrest or detention, and two breach of bail charges. Limited information is available about the case, but according to court documents and scanner chatter, a person received a photo of Kowalski with a firearm, which raised concerns, and they called Henniker police. A lieutenant and three officers were sent to Browns Way around 7:30 p.m. on May 30 for a welfare check on the woman. Police attempted to capture her, but she fled via a trail along railroad tracks near the property, according to scanner chatter. During the incident, Kowalski was accused of threatening the off