SWKS Stock Recent News

SWKS LATEST HEADLINES

Skyworks Solutions said on Monday Philip Carter will rejoin the chipmaker as its chief financial officer, effective September 8.

IRVINE, Calif.--(BUSINESS WIRE)--Skyworks Solutions, Inc. (Nasdaq: SWKS), a global leader in high-performance analog and mixed-signal semiconductors, today announced that Philip Carter has been appointed senior vice president and chief financial officer (CFO) of the company, effective September 8, 2025. Carter will be responsible for Skyworks' financial strategy, investor relations, treasury and leadership of the global finance and information technology organizations. Carter joins Skyworks fro.

I focus on companies with consistent annual dividend increases, signaling financial strength and reliable cash flow for long-term investors. This week's highlighted list features firms with an average dividend increase of 10.4% and a median dividend streak of 21 years. Goldman Sachs delivers a wonderful 33% increase and has become a total return story.

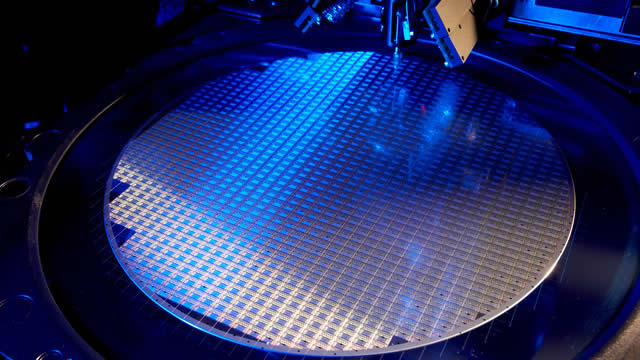

IRVINE, Calif.--(BUSINESS WIRE)--Skyworks Solutions, Inc. (Nasdaq: SWKS), a global leader in high-performance analog and mixed-signal semiconductors, today unveiled the SKY53510/80/40 family of clock fanout buffers—designed to meet the stringent timing demands of next-generation high-speed infrastructure. With the rollout of PCIe Gen 7 and the continued expansion of AI, cloud computing, and 5G/6G networks, timing precision has become a critical enabler of performance. The SKY53510/80/40 family.

The rapid proliferation of the edge IoT, AI data centers and automotive electrification, as well as the adoption of WiFi 6E and WiFi 7, is enhancing the prospects of SWKS and RFIL despite challenging macroeconomic conditions.

Skyworks Solutions, Inc. (NASDAQ:SWKS ) KeyBanc Technology Leadership Forum Conference August 12, 2025 5:00 PM ET Company Participants Philip Gordon Brace - CEO, President & Director Conference Call Participants John Nguyen Vinh - KeyBanc Capital Markets Inc., Research Division John Nguyen Vinh Great. Well, good afternoon, everybody.

SWKS jumps after fiscal Q3 earnings and revenues beat; strong Mobile demand and Android launches drive growth.

IRVINE, Calif.--(BUSINESS WIRE)--Skyworks Solutions, Inc. (Nasdaq: SWKS), an innovator of high-performance analog and mixed-signal semiconductors connecting people, places and things, today announced that executives will participate in a fireside chat at the KeyBanc Technology Leadership Forum Conference on Aug. 12, 2025, at 3 p.m. MDT from the Montage Hotel in Deer Valley, Utah. The event will be webcast live and archived for replay for one week following the conference in the “Investors” sect.

Skyworks Solutions, Inc. (NASDAQ:SWKS ) Q3 2025 Earnings Conference Call August 5, 2025 4:30 PM ET Company Participants Philip Gordon Brace - CEO, President & Director Rajvindra S. Gill - Vice President of Investor Relations Robert A.

Apple supplier Skyworks Solutions forecast fourth-quarter revenue and profit above Wall Street expectations on Tuesday, benefiting from steady demand for its analog chips amid economic uncertainty, sending its shares up around 10% in extended trading.