SYK Stock Recent News

SYK LATEST HEADLINES

Stryker Corporation (NYSE:SYK ) Wells Fargo 20th Annual Healthcare Conference 2025 September 4, 2025 2:15 PM EDT Company Participants Jason Beach - Vice President of Finance & Investor Relations J. Pierce - Group President of MedSurg & Neurotechnology Conference Call Participants Larry Biegelsen - Wells Fargo Securities, LLC, Research Division Presentation Larry Biegelsen Senior Medical Device Equity Research Analyst I'm Larry Biegelsen, the Medical Device analyst at Wells Fargo, and it's my pleasure to host this fireside chat with the management team from Stryker.

Investors with an interest in Medical - Products stocks have likely encountered both Smith & Nephew (SNN) and Stryker (SYK). But which of these two stocks presents investors with the better value opportunity right now?

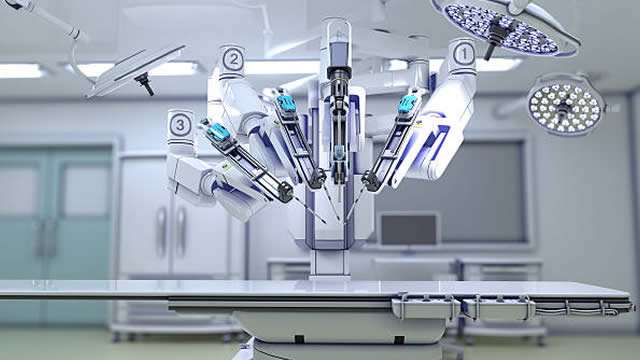

SYK posted strong Q2 growth driven by Mako robotics and global demand, but inflation, FX and competitive pressures temper near-term upside.

I reiterate a Hold rating on Stryker Corporation, with a fair value of $382 per share, despite recent strong quarterly results. Stryker's Mako installations and utilization remain robust, and upcoming Mako Spine and shoulder launches are on track to drive future growth. SYK management is focused on margin expansion through supply chain efficiencies, but cost synergies from past acquisitions remain under-realized.

Stryker continues to outperform peers with strong revenue growth, margin expansion, and successful product innovation. Recent quarterly results beat expectations, driven by robust performance across the business and ongoing market share gains. Management remains focused on growth and margin optimization, with M&A and innovation — especially in robotics and neuromodulation — central to the strategy.

Investors with an interest in Medical - Products stocks have likely encountered both Smith & Nephew (SNN) and Stryker (SYK). But which of these two stocks is more attractive to value investors?

Portage, Michigan, Aug. 15, 2025 (GLOBE NEWSWIRE) -- Stryker (NYSE:SYK) announced that it will host an Investor Day on Thursday, November 13, 2025, at 2:30 p.m. Eastern Time, in Mahwah, New Jersey.

Portage, Michigan, Aug. 14, 2025 (GLOBE NEWSWIRE) -- Stryker (NYSE:SYK) will participate in the 2025 Wells Fargo Securities Healthcare Conference on Thursday, September 4, at the Encore Boston Harbor. Andy Pierce, Group President, MedSurg and Neurotechnology, and Jason Beach, Vice President, Finance and Investor Relations will participate in a Fireside Chat scheduled for 2:15 pm Eastern Time.

Try the GARP strategy when seeking a profitable portfolio of stocks offering optimum value and growth investing. RL, SYK, RGLD and ADSK hold promise.

BALTIMORE, Aug. 07, 2025 (GLOBE NEWSWIRE) -- Longeviti Neuro Solutions, a neurotechnology company with a focus on innovative platform solutions for complex brain disorders, today announces the appointment of Tim Scannell, former President & COO of Stryker Corporation, as Chair of its Board of Directors. The company also reveals a $10 million strategic capital partnership with Soleus Capital to accelerate hiring, product development, and medical education efforts in the United States and abroad.