TER Stock Recent News

TER LATEST HEADLINES

NOVI, Mich.--(BUSINESS WIRE)---- $TER #AI--At Automate 2025, UR and MiR will showcase new automated workflows across automotive, electronics manufacturing, and logistics zones.

Besides Wall Street's top -and-bottom-line estimates for Teradyne (TER), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended March 2025.

Teradyne (TER) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

In the closing of the recent trading day, Teradyne (TER) stood at $73.65, denoting a +1.88% change from the preceding trading day.

NORTH READING, Mass.--(BUSINESS WIRE)--Teradyne, Inc. (NASDAQ: TER) will release financial results for the first quarter 2025 on Monday, April 28, at 5:00 p.m. Eastern Time (ET) or later. A conference call to discuss the first quarter results, along with management's business outlook, will follow at 8:30 a.m. ET, Tuesday, April 29, 2025. Interested investors should access the webcast at investors.teradyne.com/events-presentations at least five minutes before the call begins. Presentation materi.

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Investors looking for stocks in the Electronics - Miscellaneous Products sector might want to consider either Hayward Holdings, Inc. (HAYW) or Teradyne (TER). But which of these two stocks offers value investors a better bang for their buck right now?

Teradyne (TER) closed at $82.60 in the latest trading session, marking a -0.22% move from the prior day.

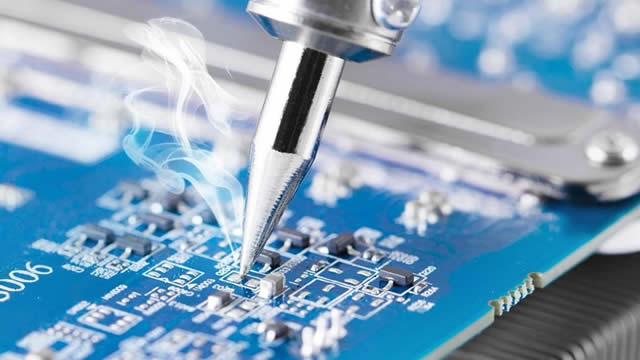

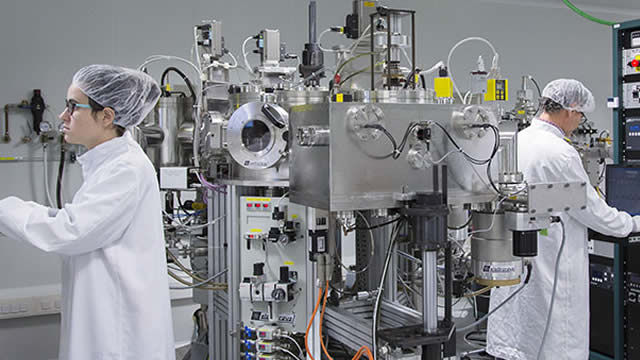

NORTH READING, Mass.--(BUSINESS WIRE)--Teradyne, a leading provider of automated test equipment, has partnered with ficonTEC, a global leader in production solutions for photonics assembly and test, to announce the availability of the first high-volume, double-sided wafer probe test cell for silicon photonics. This innovative solution is designed to meet the growing demand for high-throughput electro-optical testing of silicon photonic wafers driven by co-packaged optics (CPO) applications. The.

In the latest trading session, Teradyne (TER) closed at $89.95, marking a -1.15% move from the previous day.