TGT Stock Recent News

TGT LATEST HEADLINES

With chipmaker Taiwan Semiconductor looking very strong, investors might consider a "target strike butterfly" on TSMC stock.

VANCOUVER, British Columbia, July 24, 2025 (GLOBE NEWSWIRE) -- Brixton Metals Corporation (TSX-V: BBB, OTCQB: BBBXF) (the “Company” or “Brixton”) is pleased to announce that it has begun drilling at the newly identified Catalyst Copper-Gold Porphyry Target at its wholly owned Thorn Project located in NW British Columbia, Canada. The Thorn Project is an underexplored copper-gold porphyry district with several large-scale exploration target areas identified. Drilling is ongoing at its Trapper Gold Target and a second drill is now operational at the Catalyst Target.

With so many great investments to choose from on the stock market, why would anyone ever double up on a dividend stock?

VANCOUVER, British Columbia – TheNewswire - July 23, 2025 – Carrier Connect Data Solutions Inc. (TSX.V:CCDS; OTCQB:CCDSF; WKN : A40XB1 ) (the “Company” or “Carrier”) reports that it has completed its previously announced acquisition of all outstanding share capital of Nexion W1 DC Pty Ltd. (the “Target”) from Nexion Group Ltd. (the “Vendor”) pursuant to the terms of a share purchase agreement dated July 10, 2025 (the “Agreement”). The Target operates a 2 Megawatt Tier II/III data center in Perth, Australia servicing the Asia Pacific region. The acquisition marks a significant milestone in the Company's international expansion strategy, positioning the Company as a growing consolidator of data center infrastructure globally.

The stubbornly strong stock market is giving traders and opportunity to bet against some of the most volatile names.

The final trades of the day with CNBC's Melissa Lee and the Fast Money traders.

TGT's store-as-hub model drives 96% of sales fulfillment and powers growth in same-day services despite headwinds.

THUNDER BAY, ON / ACCESS Newswire / July 22, 2025 / Clean Air Metals Inc. ("Clean Air Metals" or the "Company") (TSXV:AIR)(FRA:CKU)(OTCQB:CLRMF) is pleased to announce its upcoming 2025 summer drilling program aimed at testing the interpreted down-plunge extension of the Escape Deposit at its 100%-owned Thunder Bay North Critical Minerals Project ("TBN"). An initial 900-m hole, targeting one of three newly identified ‘ballroom-type' coincident magnetic and conductivity anomalies, will commence this week.

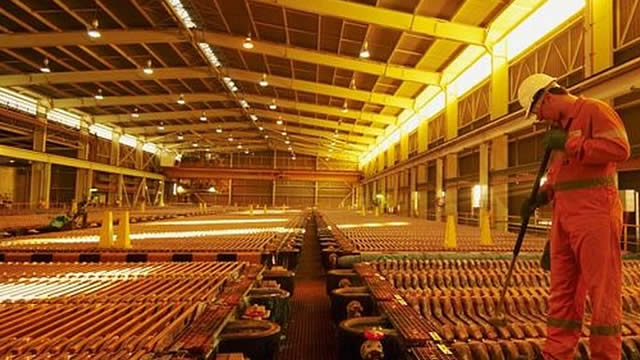

164 RC holes planned to test extensions of area drilled in 2024, with Maiden Resource Estimate to follow Vancouver, British Columbia--(Newsfile Corp. - July 22, 2025) - Midnight Sun Mining Corp. (TSXV: MMA) (OTC Pink: MDNGF) ("Midnight Sun" or the "Company") is pleased to announce the commencement of the expansion drilling program at the Kazhiba-Main oxide copper target on the Company's Solwezi Project in Zambia. Initial reverse circulation ("RC") drilling at Kazhiba-Main took place in November 2024 and yielded strong results; however, to date, only ~40% of the geochemical anomaly has been tested (See the Company's News Release dated January 29, 2025 ).

The back-to-school savings event runs July 27-Aug. 2 in stores and on Target.com The retailer will offer savings on hundreds of back-to-school items, plus deals of up to 30% off select backpacks, kids' clothing, school supplies and more Target is bringing back its popular personalization stations, doubling the number of participating stores to nearly 500 MINNEAPOLIS , July 22, 2025 /PRNewswire/ -- Target Corporation (NYSE: TGT) today announced its "Back-to-School-idays" savings event July 27-Aug. 2, featuring discounts of up to 30% on key school items like select backpacks and kids' apparel. The retailer will also host in-store experiences and giveaways to make shopping fun and affordable as consumers prepare for the upcoming school year.