THR Stock Recent News

THR LATEST HEADLINES

Thermon Group Holdings, Inc. (NYSE:THR ) Q1 2026 Earnings Conference Call August 7, 2025 11:00 AM ET Company Participants Bruce A. Thames - President, CEO & Director Ivonne Salem - Vice President of FP&A and Investor Relations Jan L.

Thermon Group (THR) came out with quarterly earnings of $0.36 per share, missing the Zacks Consensus Estimate of $0.37 per share. This compares to earnings of $0.38 per share a year ago.

AUSTIN, TX / ACCESS Newswire / August 7, 2025 / Thermon Group Holdings, Inc. (NYSE:THR) ("Thermon" or the "Company"), a global leader in industrial process heating solutions, today announced consolidated results for the first quarter ("Q1 2026") of the fiscal year ending March 31, 2026 ("Fiscal 2026"). FIRST QUARTER 2026 HIGHLIGHTS (all comparisons versus the prior year period unless otherwise noted) Revenue of $108.9 million, (5.4)% Gross profit of $48.0 million, (4.7)%; Gross Margin of 44.1% Net income of $8.6 million, +1.2%, or $0.26 earnings per diluted share (EPS) Adjusted Net Income (non-GAAP) of $12.1 million, (7.6)%, or $0.36 Adjusted EPS (non-GAAP) Adjusted EBITDA (non-GAAP) of $21.2 million, (8.6)%; Adjusted EBITDA margin (non-GAAP) of 19.5% New orders of $120.7 million, (5.1)%; book-to-bill ratio of 1.11x Net Leverage ratio of 1.0x as of June 30, 2025 Confirming full-year 2026 guidance MANAGEMENT COMMENTARY "First quarter backlog conversion fell short of our expectations del

AUSTIN, TX / ACCESS Newswire / July 31, 2025 / Thermon Group Holdings, Inc. (NYSE:THR) ("Thermon") will issue a press release reporting its consolidated financial results for the first quarter of the fiscal year ending March 31, 2026, before the market opens on Thursday, August 7, 2025. Following the earnings release, Bruce Thames, President and Chief Executive Officer, and Jan Schott, Senior Vice President and Chief Financial Officer, will host a conference call at 10:00 a.m.

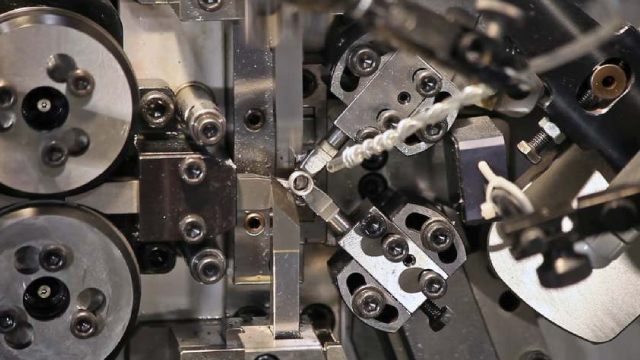

AUSTIN, TX / ACCESS Newswire / July 29, 2025 / Thermon Group Holdings, Inc. (NYSE:THR) ("Thermon"), a global leader in thermal management, power distribution, and environmental controls, today announced its universal availability of their new Poseidon™ Liquid Load Bank (for US markets) and Pontus™ Liquid Load Bank (for non-US markets). These advanced systems are designed to accurately simulate real-world thermal and electrical demand, providing mission critical component test validation for data centers and other High Performance Computing (HPC) environments.

The increasing adoption of industrial automation, focus on higher energy efficiency and optimum resource utilization should drive the Zacks Instruments - Control industry. WTS, ST and THR are well-positioned to gain from the evolving market dynamics.

- The combination study, conducted in the U.S., is designed to evaluate the safety, tolerability and preliminary efficacy at Day 29 of a single-dose of ultra-long-acting subcutaneously administered ASC47 (half-life up to 40 days) in combination with four doses of semaglutide (0.5 mg, once weekly) in 28 participants with obesity. - Initiated in May 2025, all 28 participants were enrolled in less than two months.

Thor Energy PLC (AIM:THR, OTCQB:THORF, ASX:THR) shares traded higher in Monday morning's deals after it reported positive soil gas geochemistry results at the HY-Range project (RSEL 802) in South Australia. Hydrogen readings exceeding 1,000 ppm and peaking at 3,000 ppm, and helium values up to 27 ppm, the company told investors.

Thermon´s shares remain relatively cheap, but organic growth has stagnated and the recent guidance is underwhelming. Despite past acquisition-driven growth, organic sales have declined and 2026 guidance points to flattish earnings and EBITDA. Valuations has crept higher, with the earnings multiple expanding from 14x to nearly 16x despite lackluster operating performance.